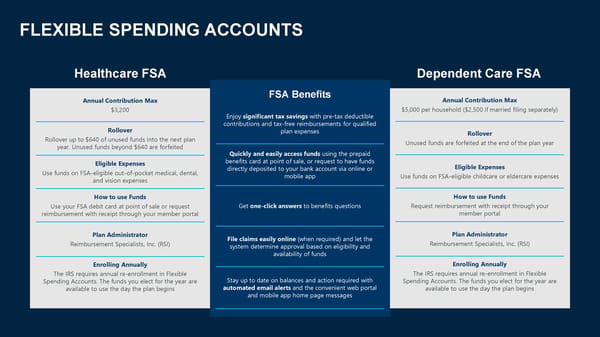

FLEXIBLE SPENDING ACCOUNTS Healthcare FSA Dependent Care FSA Annual Contribution Max FSA Benefits Annual Contribution Max $3,200 Enjoy significant tax savings with pre-tax deductible $5,000 per household ($2,500 if married filing separately) Rollover contributions and tax-free reimbursements for qualified plan expenses Rollover Rollover up to $640 of unused funds into the next plan Unused funds are forfeited at the end of the plan year year. Unused funds beyond $640 are forfeited Quickly and easily access funds using the prepaid Eligible Expenses benefits card at point of sale, or request to have funds Eligible Expenses Use funds on FSA-eligible out-of-pocket medical, dental, directly deposited to your bank account via online or and vision expenses mobile app Use funds on FSA-eligible childcare or eldercare expenses How to use Funds How to use Funds Use your FSA debit card at point of sale or request Get one-click answers to benefits questions Request reimbursement with receipt through your reimbursement with receipt through your member portal member portal Plan Administrator File claims easily online (when required) and let the Plan Administrator Reimbursement Specialists, Inc. (RSI) system determine approval based on eligibility and Reimbursement Specialists, Inc. (RSI) availability of funds Enrolling Annually Enrolling Annually The IRS requires annual re-enrollment in Flexible Stay up to date on balances and action required with The IRS requires annual re-enrollment in Flexible Spending Accounts. The funds you elect for the year are automated email alerts and the convenient web portal Spending Accounts. The funds you elect for the year are available to use the day the plan begins and mobile app home page messages available to use the day the plan begins

2024 Open Enrollment Webinar Slide Deck Page 23 Page 25

2024 Open Enrollment Webinar Slide Deck Page 23 Page 25