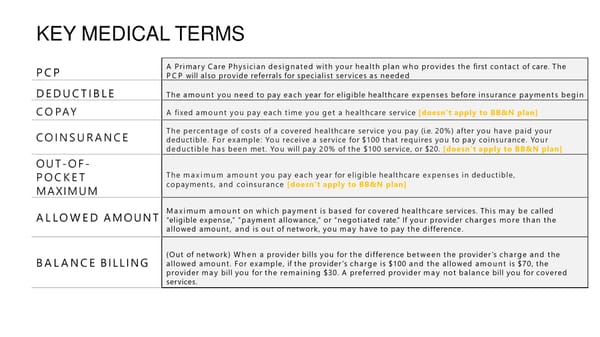

KEY MEDICAL TERMS P C P A Primar y Care Physician designated with your health plan who provides the first contact of care. The P C P will also provide referrals for specialist services as needed D E D U C T I B L E The amount you need to pay each year for eligible healthcare expenses before insurance payments begin C O PAY A fixed amount you pay each time you get a healthcare service [doesn’t apply to BB&N plan] COINSURANCE The percentage of costs of a covered healthcare service you pay (i.e. 20%) after you have paid your deductible. For example: You receive a service for $100 that requires you to pay coinsurance. Your deductible has been met. You will pay 20% of the $100 service, or $20. [doesn’t apply to BB&N plan] OUT-OF- P O C K E T MAXIMUM The m a x i m u m amount you pay each year for eligible healthcare expenses in deductible, copayments, and coinsurance [doesn’t apply to BB&N plan] A L LO W E D AMOUNT Maximum amount on which payment is based for covered healthcare services. This ma y be called “eligible expense,” “payment allowance,” or “negotiated rate.” If your provider charges more than the allowed amount, and is out of network, you ma y have to pay the difference. B A L A N C E BILLING (Out of network) Wh en a provider bills you for the difference between the provider’s charge and the allowed amount. For example, if the provider’s charge is $100 and the allowed amount is $70, the provider ma y bill you for the remaining $30. A preferred provider m a y not balance bill you for covered services.

BB&N Open Enrollment Presentation 2025-2026 Page 7 Page 9

BB&N Open Enrollment Presentation 2025-2026 Page 7 Page 9