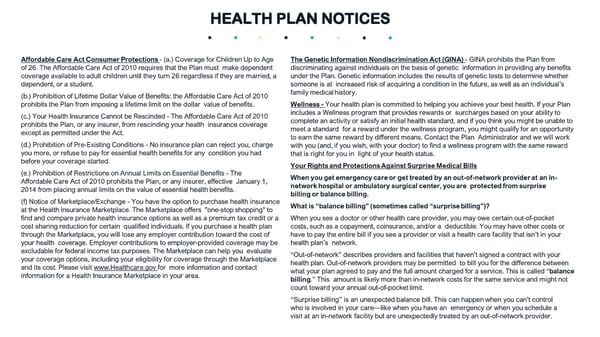

Affordable Care Act Consumer Protections - (a.) Coverage for Children Up to Age of 26. The Affordable Care Act of 2010 requires that the Plan must make dependent coverage available to adult children until they turn 26 regardless if they are married, a dependent, or a student. (b.) Prohibition of Lifetime Dollar Value of Benefits: the Affordable Care Act of 2010 prohibits the Plan from imposing a lifetime limit on the dollar value of benefits. (c.) Your Health Insurance Cannot be Rescinded - The Affordable Care Act of 2010 prohibits the Plan, or any insurer, from rescinding your health insurance coverage except as permitted under the Act. (d.) Prohibition of Pre-Existing Conditions - No insurance plan can reject you, charge you more, or refuse to pay for essential health benefits for any condition you had before your coverage started. (e.) Prohibition of Restrictions on Annual Limits on Essential Benefits - The Affordable Care Act of 2010 prohibits the Plan, or any insurer, effective January 1, 2014 from placing annual limits on the value of essential health benefits. (f) Notice of Marketplace/Exchange - You have the option to purchase health insurance at the Health Insurance Marketplace. The Marketplace offers "one-stop shopping" to find and compare private health insurance options as well as a premium tax credit or a cost sharing reduction for certain qualified individuals. If you purchase a health plan through the Marketplace, you will lose any employer contribution toward the cost of your health coverage. Employer contributions to employer-provided coverage may be excludable for federal income tax purposes. The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit www.Healthcare.gov for more information and contact information for a Health Insurance Marketplace in your area. The Genetic Information Nondiscrimination Act (GINA) - GINA prohibits the Plan from discriminating against individuals on the basis of genetic information in providing any benefits under the Plan. Genetic information includes the results of genetic tests to determine whether someone is at increased risk of acquiring a condition in the future, as well as an individual’s family medical history. Wellness - Your health plan is committed to helping you achieve your best health. If your Plan includes a Wellness program that provides rewards or surcharges based on your ability to complete an activity or satisfy an initial health standard, and if you think you might be unable to meet a standard for a reward under the wellness program, you might qualify for an opportunity to earn the same reward by different means. Contact the Plan Administrator and we will work with you (and, if you wish, with your doctor) to find a wellness program with the same reward that is right for you in light of your health status. Your Rights and Protections Against Surprise Medical Bills When you get emergency care or get treated by an out-of-network provider at an in- network hospital or ambulatory surgical center, you are protected from surprise billing or balance billing. What is “balance billing” (sometimes called “surprise billing”)? When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, such as a copayment, coinsurance, and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network. “Out-of-network” describes providers and facilities that haven’t signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit. “Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider. HEALTH PLAN NOTICES

FY26 Benefit Guide Page 29 Page 31

FY26 Benefit Guide Page 29 Page 31