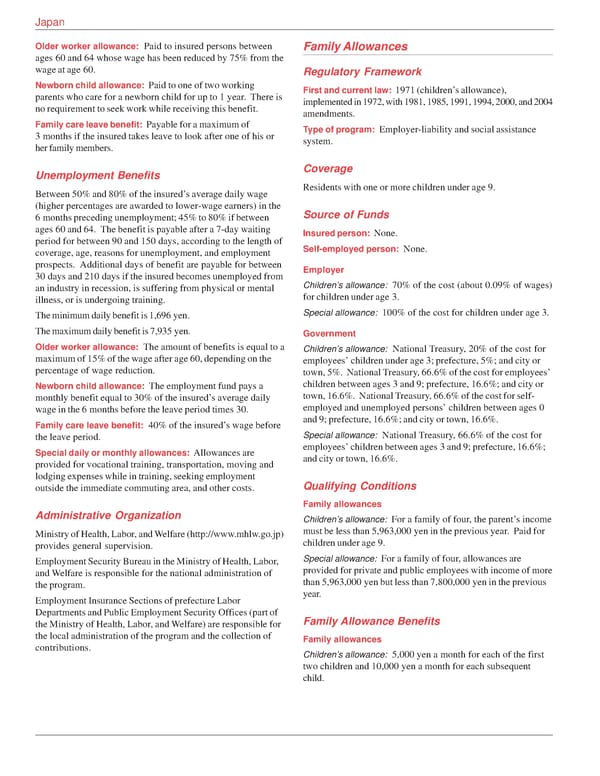

Japan Older worker allowance: Paid to insured persons between Family Allowances ages 60 and 64 whose wage has been reduced by 75% from the wage at age 60. Regulatory Framework Newborn child allowance: Paid to one of two working First and current law: 1971 (children’s allowance), parents who care for a newborn child for up to 1 year. There is implemented in 1972, with 1981, 1985, 1991, 1994, 2000, and 2004 no requirement to seek work while receiving this benefit. amendments. Family care leave benefit: Payable for a maximum of Type of program: Employer-liability and social assistance 3 months if the insured takes leave to look after one of his or system. her family members. Unemployment Benefits Coverage Between 50% and 80% of the insured’s average daily wage Residents with one or more children under age 9. (higher percentages are awarded to lower-wage earners) in the Source of Funds 6 months preceding unemployment; 45% to 80% if between ages 60 and 64. The benefit is payable after a 7-day waiting Insured person: None. period for between 90 and 150 days, according to the length of Self-employed person: None. coverage, age, reasons for unemployment, and employment prospects. Additional days of benefit are payable for between Employer 30 days and 210 days if the insured becomes unemployed from Children’s allowance: 70% of the cost (about 0.09% of wages) an industry in recession, is suffering from physical or mental for children under age 3. illness, or is undergoing training. The minimum daily benefit is 1,696 yen. Special allowance: 100% of the cost for children under age 3. The maximum daily benefit is 7,935 yen. Government Older worker allowance: The amount of benefits is equal to a Children’s allowance: National Treasury, 20% of the cost for maximum of 15% of the wage after age 60, depending on the employees’ children under age 3; prefecture, 5%; and city or percentage of wage reduction. town, 5%. National Treasury, 66.6% of the cost for employees’ Newborn child allowance: The employment fund pays a children between ages 3 and 9; prefecture, 16.6%; and city or monthly benefit equal to 30% of the insured’s average daily town, 16.6%. National Treasury, 66.6% of the cost for self- wage in the 6 months before the leave period times 30. employed and unemployed persons’ children between ages 0 Family care leave benefit: 40% of the insured’s wage before and 9; prefecture, 16.6%; and city or town, 16.6%. the leave period. Special allowance: National Treasury, 66.6% of the cost for Special daily or monthly allowances: Allowances are employees’ children between ages 3 and 9; prefecture, 16.6%; provided for vocational training, transportation, moving and and city or town, 16.6%. lodging expenses while in training, seeking employment Qualifying Conditions outside the immediate commuting area, and other costs. Family allowances Administrative Organization Children’s allowance: For a family of four, the parent’s income Ministry of Health, Labor, and Welfare (http://www.mhlw.go.jp) must be less than 5,963,000 yen in the previous year. Paid for provides general supervision. children under age 9. Employment Security Bureau in the Ministry of Health, Labor, Special allowance: For a family of four, allowances are and Welfare is responsible for the national administration of provided for private and public employees with income of more the program. than 5,963,000 yen but less than 7,800,000 yen in the previous Employment Insurance Sections of prefecture Labor year. Departments and Public Employment Security Offices (part of Family Allowance Benefits the Ministry of Health, Labor, and Welfare) are responsible for the local administration of the program and the collection of Family allowances contributions. Children’s allowance: 5,000 yen a month for each of the first two children and 10,000 yen a month for each subsequent child.

Global Benefits Assessment Sample Page 40 Page 42

Global Benefits Assessment Sample Page 40 Page 42