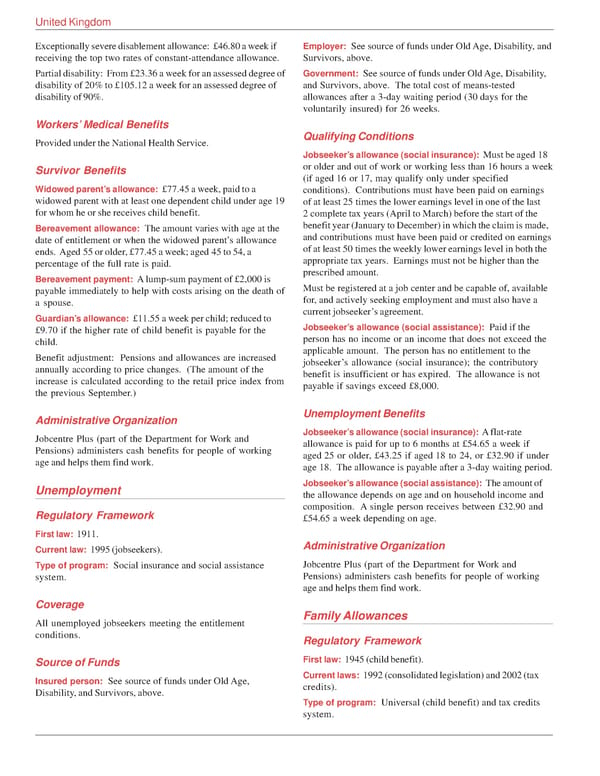

United Kingdom Exceptionally severe disablement allowance: £46.80 a week if Employer: See source of funds under Old Age, Disability, and receiving the top two rates of constant-attendance allowance. Survivors, above. Partial disability: From £23.36 a week for an assessed degree of Government: See source of funds under Old Age, Disability, disability of 20% to £105.12 a week for an assessed degree of and Survivors, above. The total cost of means-tested disability of 90%. allowances after a 3-day waiting period (30 days for the voluntarily insured) for 26 weeks. Workers’ Medical Benefits Provided under the National Health Service. Qualifying Conditions Jobseeker’s allowance (social insurance): Must be aged 18 Survivor Benefits or older and out of work or working less than 16 hours a week (if aged 16 or 17, may qualify only under specified Widowed parent’s allowance: £77.45 a week, paid to a conditions). Contributions must have been paid on earnings widowed parent with at least one dependent child under age 19 of at least 25 times the lower earnings level in one of the last for whom he or she receives child benefit. 2 complete tax years (April to March) before the start of the Bereavement allowance: The amount varies with age at the benefit year (January to December) in which the claim is made, date of entitlement or when the widowed parent’s allowance and contributions must have been paid or credited on earnings ends. Aged 55 or older, £77.45 a week; aged 45 to 54, a of at least 50 times the weekly lower earnings level in both the percentage of the full rate is paid. appropriate tax years. Earnings must not be higher than the Bereavement payment: A lump-sum payment of £2,000 is prescribed amount. payable immediately to help with costs arising on the death of Must be registered at a job center and be capable of, available a spouse. for, and actively seeking employment and must also have a Guardian’s allowance: £11.55 a week per child; reduced to current jobseeker’s agreement. £9.70 if the higher rate of child benefit is payable for the Jobseeker’s allowance (social assistance): Paid if the child. person has no income or an income that does not exceed the Benefit adjustment: Pensions and allowances are increased applicable amount. The person has no entitlement to the annually according to price changes. (The amount of the jobseeker’s allowance (social insurance); the contributory increase is calculated according to the retail price index from benefit is insufficient or has expired. The allowance is not the previous September.) payable if savings exceed £8,000. Administrative Organization Unemployment Benefits Jobcentre Plus (part of the Department for Work and Jobseeker’s allowance (social insurance): A flat-rate Pensions) administers cash benefits for people of working allowance is paid for up to 6 months at £54.65 a week if age and helps them find work. aged 25 or older, £43.25 if aged 18 to 24, or £32.90 if under age 18. The allowance is payable after a 3-day waiting period. Unemployment Jobseeker’s allowance (social assistance): The amount of the allowance depends on age and on household income and Regulatory Framework composition. A single person receives between £32.90 and £54.65 a week depending on age. First law: 1911. Current law: 1995 (jobseekers). Administrative Organization Type of program: Social insurance and social assistance Jobcentre Plus (part of the Department for Work and system. Pensions) administers cash benefits for people of working age and helps them find work. Coverage Family Allowances All unemployed jobseekers meeting the entitlement conditions. Regulatory Framework Source of Funds First law: 1945 (child benefit). Insured person: See source of funds under Old Age, Current laws: 1992 (consolidated legislation) and 2002 (tax Disability, and Survivors, above. credits). Type of program: Universal (child benefit) and tax credits system.

Global Benefits Assessment Sample Page 46 Page 48

Global Benefits Assessment Sample Page 46 Page 48