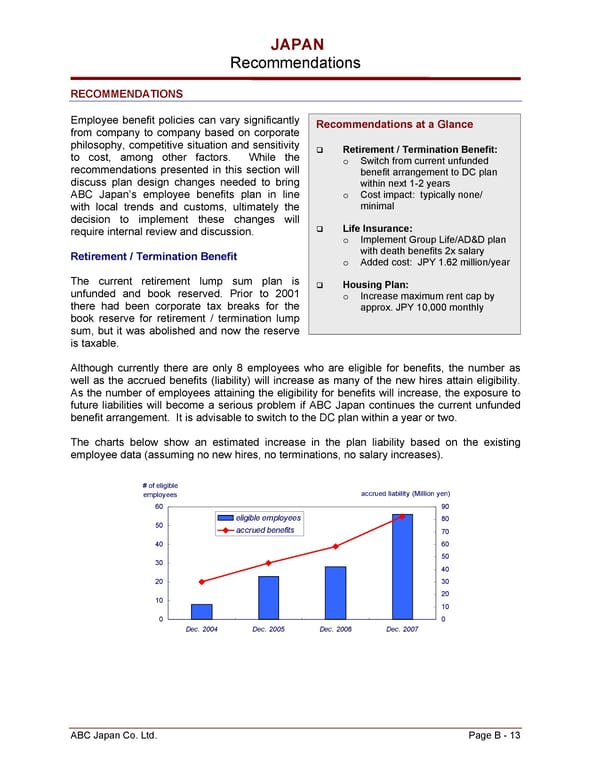

JAPAN Recommendations RECOMMENDATIONS Employee benefit policies can vary significantly Recommendations at a Glance from company to company based on corporate philosophy, competitive situation and sensitivity ‰ Retirement / Termination Benefit: to cost, among other factors. While the o Switch from current unfunded recommendations presented in this section will benefit arrangement to DC plan discuss plan design changes needed to bring within next 1-2 years ABC Japan’s employee benefits plan in line o Cost impact: typically none/ with local trends and customs, ultimately the minimal decision to implement these changes will require internal review and discussion. ‰ Life Insurance: o Implement Group Life/AD&D plan Retirement / Termination Benefit with death benefits 2x salary o Added cost: JPY 1.62 million/year The current retirement lump sum plan is ‰ Housing Plan: unfunded and book reserved. Prior to 2001 o Increase maximum rent cap by there had been corporate tax breaks for the approx. JPY 10,000 monthly book reserve for retirement / termination lump sum, but it was abolished and now the reserve is taxable. Although currently there are only 8 employees who are eligible for benefits, the number as well as the accrued benefits (liability) will increase as many of the new hires attain eligibility. As the number of employees attaining the eligibility for benefits will increase, the exposure to future liabilities will become a serious problem if ABC Japan continues the current unfunded benefit arrangement. It is advisable to switch to the DC plan within a year or two. The charts below show an estimated increase in the plan liability based on the existing employee data (assuming no new hires, no terminations, no salary increases). # of eligible employees accrued liability (Million yen) 60 90 eligible employees 80 50 accrued benefits 70 40 60 30 50 40 20 30 10 20 10 0 0 Dec. 2004 Dec. 2005 Dec. 2006 Dec. 2007 ABC Japan Co. Ltd. Page B - 13

Global Benefits Assessment Sample Page 18 Page 20

Global Benefits Assessment Sample Page 18 Page 20