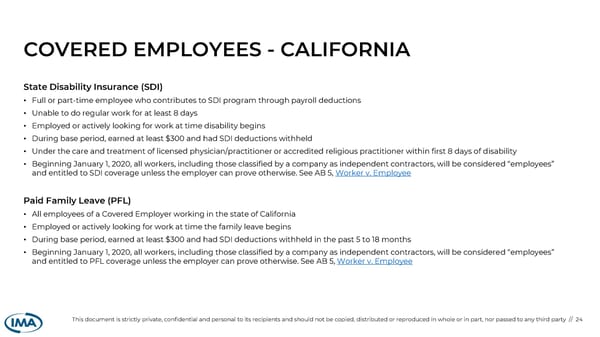

COVERED EMPLOYEES - CALIFORNIA State Disability Insurance (SDI) • Full or part-time employee who contributes to SDI program through payroll deductions • Unable to do regular work for at least 8 days • Employed or actively looking for work at time disability begins • During base period, earned at least $300 and had SDI deductions withheld • Under the care and treatment of licensed physician/practitioner or accredited religious practitioner within first 8 days of disability • Beginning January 1, 2020, all workers, including those classified by a company as independent contractors, will be considered “employees” and entitled to SDI coverage unless the employer can prove otherwise. See AB 5, Worker v. Employee Paid Family Leave (PFL) • All employees of a Covered Employer working in the state of California • Employed or actively looking for work at time the family leave begins • During base period, earned at least $300 and had SDI deductions withheld in the past 5 to 18 months • Beginning January 1, 2020, all workers, including those classified by a company as independent contractors, will be considered “employees” and entitled to PFL coverage unless the employer can prove otherwise. See AB 5, Worker v. Employee This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party // 24

Overview of State Paid Leave Laws Page 23 Page 25

Overview of State Paid Leave Laws Page 23 Page 25