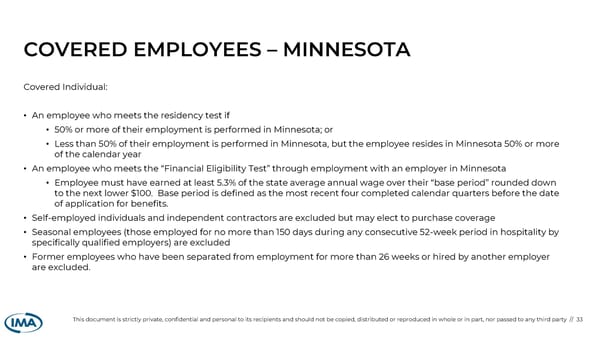

COVERED EMPLOYEES – MINNESOTA Covered Individual: • An employee who meets the residency test if • 50% or more of their employment is performed in Minnesota; or • Less than 50% of their employment is performed in Minnesota, but the employee resides in Minnesota 50% or more of the calendar year • An employee who meets the “Financial Eligibility Test” through employment with an employer in Minnesota • Employee must have earned at least 5.3% of the state average annual wage over their “base period” rounded down to the next lower $100. Base period is defined as the most recent four completed calendar quarters before the date of application for benefits. • Self-employed individuals and independent contractors are excluded but may elect to purchase coverage • Seasonal employees (those employed for no more than 150 days during any consecutive 52-week period in hospitality by specifically qualified employers) are excluded • Former employees who have been separated from employment for more than 26 weeks or hired by another employer are excluded. This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party // 33

Overview of State Paid Leave Laws Page 32 Page 34

Overview of State Paid Leave Laws Page 32 Page 34