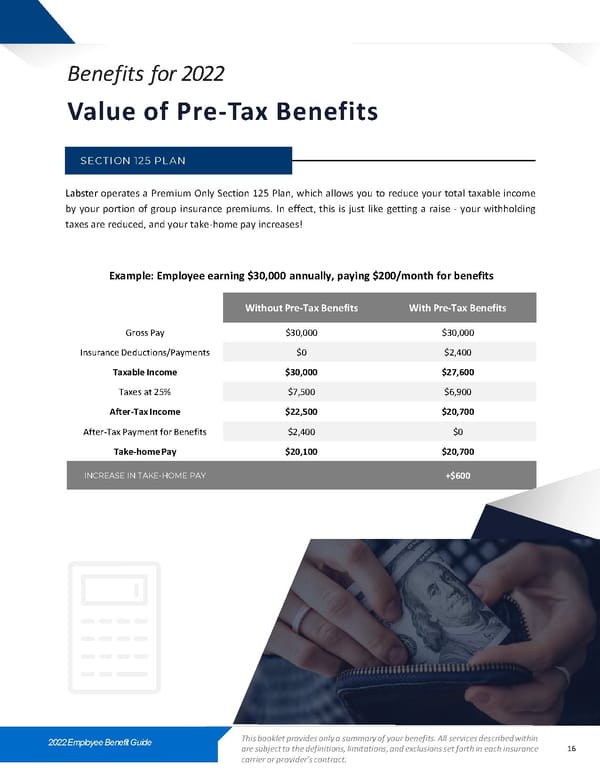

Benefits for 2022 Value of Pre-Tax Benefits SECTION 125 PLAN Labster operates a Premium Only Section 125 Plan, which allows you to reduce your total taxable income by your portion of group insurance premiums. In effect, this is just like getting a raise - your withholding taxes are reduced, and your take-homepay increases! Example: Employee earning $30,000 annually, paying $200/month for benefits Without Pre-Tax Benefits With Pre-Tax Benefits Gross Pay $30,000 $30,000 Insurance Deductions/Payments $0 $2,400 Taxable Income $30,000 $27,600 Taxes at 25% $7,500 $6,900 After-Tax Income $22,500 $20,700 After-Tax Payment for Benefits $2,400 $0 Take-home Pay $20,100 $20,700 INCREASEIN TAKE-HOME PAY +$600 2022 Employee Benefit Guide This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance 16 carrier or provider’s contract.

2022 Labster Benefit Guide Page 15 Page 17

2022 Labster Benefit Guide Page 15 Page 17