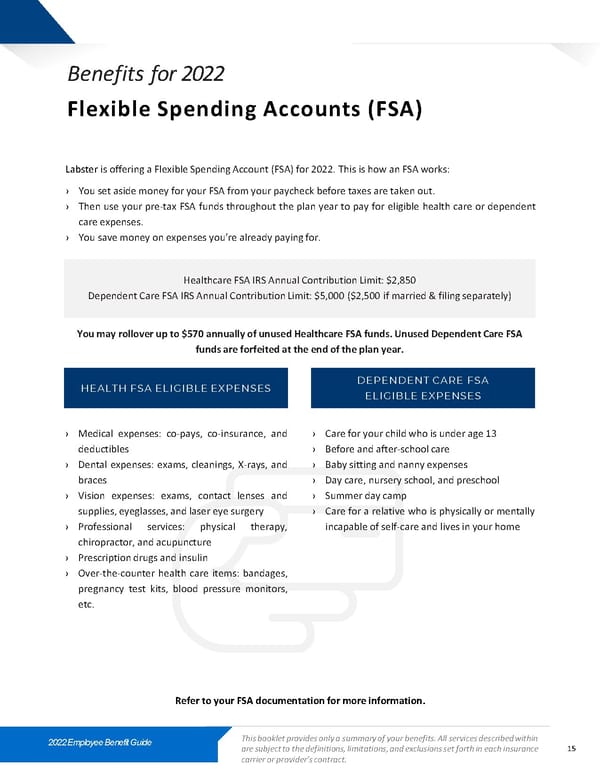

Benefits for 2022 Flexible Spending Accounts (FSA) Labster is offering a FlexibleSpendingAccount (FSA) for 2022. This ishow an FSA works: › YousetasidemoneyforyourFSAfromyourpaycheckbeforetaxesaretakenout. › Then use your pre-tax FSA funds throughout the plan year to pay for eligible health care or dependent care expenses. › Yousavemoneyonexpensesyou’realreadypayingfor. Healthcare FSA IRS Annual Contribution Limit: $2,850 Dependent Care FSA IRS Annual Contribution Limit: $5,000 ($2,500 if married & filing separately) You may rollover up to $570 annually of unused Healthcare FSA funds. Unused Dependent Care FSA funds are forfeited at the end of the plan year. HEALTH FSA ELIGIBLE EXPENSES DEPENDENT CARE FSA ELIGIBLE EXPENSES › Medical expenses: co-pays, co-insurance, and › Careforyour childwhoisunderage13 deductibles › Beforeandafter-schoolcare › Dental expenses: exams, cleanings, X-rays, and › Babysittingandnannyexpenses braces › Daycare,nurseryschool, andpreschool › Vision expenses: exams, contact lenses and › Summerdaycamp supplies,eyeglasses,and laser eye surgery › Care for a relative who is physically or mentally › Professional services: physical therapy, incapableof self-careand livesinyour home chiropractor, and acupuncture › Prescriptiondrugsand insulin › Over-the-counter health care items: bandages, pregnancy test kits, blood pressure monitors, etc. Refer to your FSA documentation for more information. 2022 Employee Benefit Guide This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance 15 carrier or provider’s contract.

2022 Labster Benefit Guide Page 14 Page 16

2022 Labster Benefit Guide Page 14 Page 16