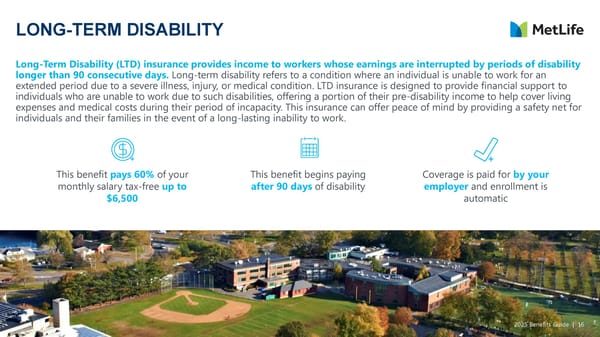

LONG-TERM DISABILITY Long-Term Disability (LTD) insurance provides income to workers whose earnings are interrupted by periods of disability longer than 90 consecutive days. Long-term disability refers to a condition where an individual is unable to work for an extended period due to a severe illness, injury, or medical condition. LTD insurance is designed to provide financial support to individuals who are unable to work due to such disabilities, offering a portion of their pre-disability income to help cover living expenses and medical costs during their period of incapacity. This insurance can offer peace of mind by providing a safety net for individuals and their families in the event of a long-lasting inability to work. This benefit pays 60% of your monthly salary tax-free up to $6,500 Coverage is paid for by your employer and enrollment is automatic This benefit begins paying after 90 days of disability 2025 Benefits Guide | 16

2025-2026 Benefits Guide Page 16 Page 18

2025-2026 Benefits Guide Page 16 Page 18