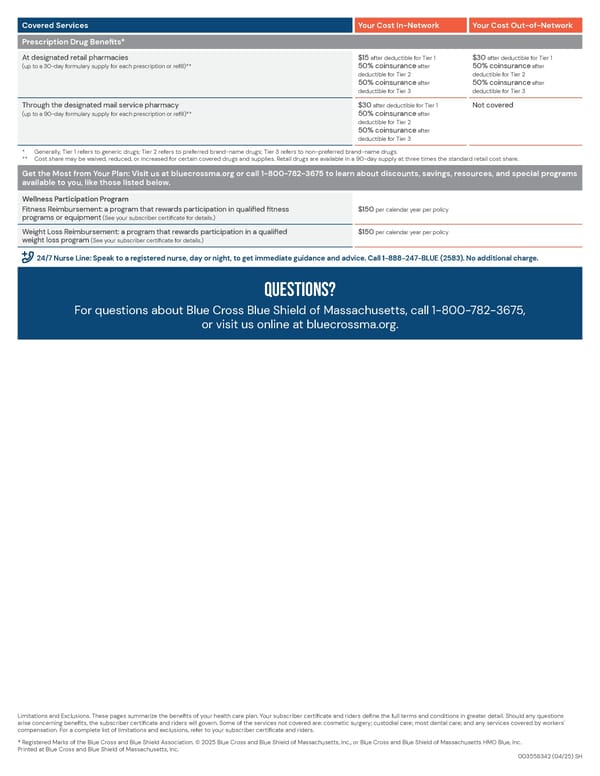

Limitations and Exclusions. These pages summarize the benefits of your health care plan. Your subscriber certificate and riders define the full terms and conditions in greater detail. Should any questions arise concerning benefits, the subscriber certificate and riders will govern. Some of the services not covered are: cosmetic surgery; custodial care; most dental care; and any services covered by workers’ compensation. For a complete list of limitations and exclusions, refer to your subscriber certificate and riders. ® Registered Marks of the Blue Cross and Blue Shield Association. © 2025 Blue Cross and Blue Shield of Massachusetts, Inc., or Blue Cross and Blue Shield of Massachusetts HMO Blue, Inc. Printed at Blue Cross and Blue Shield of Massachusetts, Inc. 003558342 (04/25) SH Questions? For questions about Blue Cross Blue Shield of Massachusetts, call 1-800-782-3675, or visit us online at bluecrossma.org. Covered Services Your Cost In-Network Your Cost Out-of-Network Prescription Drug Benefits* At designated retail pharmacies (up to a 30-day formulary supply for each prescription or refill)** $15 after deductible for Tier 1 50% coinsurance after deductible for Tier 2 50% coinsurance after deductible for Tier 3 $30 after deductible for Tier 1 50% coinsurance after deductible for Tier 2 50% coinsurance after deductible for Tier 3 Through the designated mail service pharmacy (up to a 90-day formulary supply for each prescription or refill)** $30 after deductible for Tier 1 50% coinsurance after deductible for Tier 2 50% coinsurance after deductible for Tier 3 Not covered * Generally, Tier 1 refers to generic drugs; Tier 2 refers to preferred brand-name drugs; Tier 3 refers to non-preferred brand-name drugs. ** Cost share may be waived, reduced, or increased for certain covered drugs and supplies. Retail drugs are available in a 90-day supply at three times the standard retail cost share. Get the Most from Your Plan: Visit us at bluecrossma.org or call 1-800-782-3675 to learn about discounts, savings, resources, and special programs available to you, like those listed below. Wellness Participation Program Fitness Reimbursement: a program that rewards participation in qualified fitness programs or equipment (See your subscriber certificate for details.) $150 per calendar year per policy Weight Loss Reimbursement: a program that rewards participation in a qualified weight loss program (See your subscriber certificate for details.) $150 per calendar year per policy 24/7 Nurse Line: Speak to a registered nurse, day or night, to get immediate guidance and advice. Call 1-888-247-BLUE (2583). No additional charge.

BlueCross BlueShield Preferred Blue PPO Basic Saver Summary Page 3 Page 5

BlueCross BlueShield Preferred Blue PPO Basic Saver Summary Page 3 Page 5