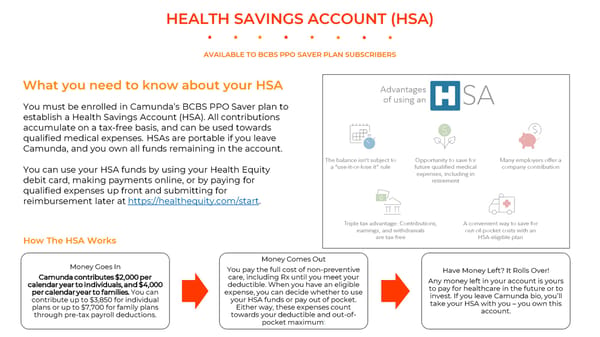

HEALTH SAVINGS ACCOUNT (HSA) AVAILABLE TO BCBS PPO SAVER PLAN SUBSCRIBERS What you need to know about your HSA You must be enrolled in Camunda’s BCBS PPO Saver plan to establish a Health Savings Account (HSA). All contributions accumulate on a tax-free basis, and can be used towards qualified medical expenses. HSAs are portable if you leave Camunda, and you own all funds remaining in the account. You can use your HSA funds by using your Health Equity debit card, making payments online, or by paying for qualified expenses up front and submitting for https://healthequity.com/start. reimbursement later at How The HSA Works Money Comes Out Money Goes In You pay the full cost of non-preventive Have Money Left? It Rolls Over! Camunda contributes $2,000 per care, including Rx until you meet your Any money left in your account is yours calendar year to individuals, and $4,000 deductible. When you have an eligible to pay for healthcare in the future or to per calendar year to families. You can expense, you can decide whether to use invest. If you leave Camunda bio, you’ll contribute up to $3,850 for individual your HSA funds or pay out of pocket. take your HSA with you – you own this plans or up to $7,700 for family plans Either way, these expenses count account. through pre-tax payroll deductions. towards your deductible and out-of- pocket maximum:

Camunda 2023 Employee Benefit Guide Page 9 Page 11

Camunda 2023 Employee Benefit Guide Page 9 Page 11