Camunda 2023 Employee Benefit Guide

CONTENTS CLICK MENU ITEMS TO JUMP TO CONTENT ELIGIBILITY DENTAL PLAN COSTS & CONTACTS DENTAL PLAN EDUCATION MEDICAL PLAN OPTIONS VISION PLAN BCBS MEMBER PERKS VISION PLAN EDUCATION MEDICAL PLAN EDUCATION BASIC LIFE, VOLUNTARY LIFE & DISABILITY HEALTHY ACTIONS 401(K) RETIREMENT PLAN HEALTH SAVINGS ACCOUNT (HSA) TOUCHARE EMPLOYEE SUPPORT HSA EDUCATION PARENTAL LEAVE & PTO HEALTH REIMBURSEMENT ARRANGEMENT (HRA) EMPLOYEE ASSISTANCE PROGRAM (EAP) HEALTH CARE FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DOCUMENTS DEPENDENT CARE FSA HEALTH PLAN NOTICES 2 // 2023 Employee Benefit Guide

ELIGIBILITY BENEFITS PLAN YEAR 1/1/23 – 12/31/23 All full-time employees and their Passive Enrollment means that unless you Who is eligible to enroll eligible dependents. Employees make a change to your benefits during the in benefits? must be at least 21 years of age to open enrollment period, all of your benefits enroll in the 401(k)-retirement plan from the 2022 will automatically roll over into What constitutes a full- An employee actively working on 2023. This does not include your FSA elections, time employee? average 30 or more hours per work which require annual enrollment per IRS week regulations. If you would like to continue to contribute to your FSA in 2023, you must take Who is considered an Spouse, domestic partner (DP), action during the 2022 enrollment period. eligible dependent? child(ren) under the age of 26, and children of DP under age 26 When am I eligible to Imputed income will apply for costs related to Domestic Partners or Ex- enroll in benefits? On your date of hire spouses. Please contact HR for more information on these costs.. This guide is a brief summary of benefits offered to your group and does not constitute a policy. The company reserves to itself, pursuant to its sole You may only change during and exclusive discretion, the right to change, amend or terminate the When can I change my Camunda’s annual open enrollment benefits program at any time. The insurance companies plan benefit elections? period or within 30 days of a descriptions will contain the actual detailed provisions of your benefits. If qualifying life event there are any discrepancies between the information in the guide and the insurance company’s plan descriptions, the language in the insurance companies plan descriptions will always prevail. 3 // 2023 Employee Benefit Guide

COSTS AND CONTACTS CAMUNDA BENEFIT WHO PAYS? EMPLOYEE COST PER PAY PERIOD MEMBER SERVICES ONLINE PORTAL Employee $41.70 MEDICAL - BCBS PPO HRA Employee+ Spouse $125.09 Employee + Child(ren) $112.25 Camunda & you share the cost of Family $252.23 your monthly medical premiums Employee $0.00 MEDICAL - BCBS PPO HSA Employee + Spouse $0.00 (800) 262-2583 Blue Cross Blue Shield Member Portal Employee + Child(ren) $0.00 Family $0.00 Employee $0.25 DENTAL- BCBS PPO Camunda & you share the cost of Employee + Spouse $5.75 your monthly dental premiums Employee + Child(ren) $6.00 Family $13.50 Employee $3.30 VISION – VSP You cover the cost of your monthly vision Employee + Spouse $5.27 (800) 877-7195 VSP Member Portal premiums Employee + Child(ren) $5.38 Family $8.68 HEALTH EQUITY FLEXIBLE You are the sole contributor to SPENDING / DEP CARE your FSA & Dep Care Account Eligible Employees Varied ACCOUNT Employee $1,750 HEALTH EQUITY HEALTH Camunda is the sole contributor to your Employee+ Spouse $3,500 REIMBURSMENT ACCOUNT HRA accounts Employee + Child(ren) $3,500 (866) 346-5800 Health Equity Member Portal Family $3,500 Camunda contributes to your HSA Employee $2,000 HEALTH EQUITY HEALTH annually, Employee+ Spouse $4,000 SAVINGS ACCOUNT you may contribute as well Employee + Child(ren) $4,000 Family $4,000 SUNLIFE BASIC LIFE & Camunda pays 100% of your Basic Eligible Employees $0 DISABILITY Life and AD&D/ Disability Premiums (800) 786-5433 SunLife Portal SUNLIFE VOLUNTARY LIFE & You pay 100% of your Voluntary Eligible Employees Varies by age AD&D Life and AD&D premiums 4 // 2022 Employee Benefit Guide

MEDICAL PLAN OPTIONS BCBS PPO BCBS PPO Saver Group #002375437 Group #002375439 In-Network Out-of-Network In-Network Out-of-Network Total Deductible $2,000/$4,000 $2,000/$4,000 $2,900/$5,800 $6,000/$12,000 (Individual/Family) Your Deductible Responsibility $250 / $500 $2,000/$4,000 $2,900/$5,800 $6,000/$12,000 Camunda’s HRA Contribution $1,750 / $3,500 $0 / $0 N/A N/A Out of pocket Max $5,450/$10,900 $5,450/$10,900 $6,450/$12,900 $6,450/$12,900 (Individual/Family) Preventive Office Visit $0 Deductible then 20% $0 Deductible then 20% Coinsurance Coinsurance Office Visit: PCP/Specialist $15 Copay Deductible then 20% Deductible then $55 Copay Deductible then 20% Coinsurance Coinsurance Diagnostic Tests Deductible then $0 Deductible then 20% Deductible then $55 Copay Deductible then 20% Coinsurance (MRI, Labs, CT, X-Rays) Coinsurance Urgent Care $15 Copay Deductible then 20% Deductible then $0 Deductible then 20% Coinsurance Coinsurance Emergency Room $150 Copay* Deductible then $150 Copay Inpatient Care Deductible then $0 Deductible then 20% Deductible then $0 Copay Deductible then 20% Coinsurance Coinsurance Outpatient Surgical Deductible then $0 Deductible then 20% Deductible $0 Copay Deductible then 20% Coinsurance Coinsurance Prescriptions - Retail/Mail $15/$30 $15/$30 $10/$25 $10/$25 Low-Cost Generic $30/$60 $30/$60 $25/$50 $25/$50 Preferred Brand $60/$120 $60/$120 $45/$135 $45/$135 Non-Preferred Specialty 5 // 2022 Employee Benefit Guide

BCBS MEMBER PERKS WellConnection Telehealth Fitness Reimbursement Receive treatment and prescriptions Get up to $150 annually towards (when necessary) from home for a gym fees, home fitness equipment, variety of common ailments through fitness classes, or online workout Well-Connection programs learn more learn more Blue365 Discounts Weight Loss Reimbursement Access exclusive discounts on things Get up to $150 annually towards in- like gym memberships, fitness gear, person or online weight loss programs healthy eating options, and more – like Weight Watchers, or hospital- only for BCBS members based programs learn more learn more 6 // 2023 Employee Benefit Guide

MEDICAL PLAN EDUCATION myBlueMember App How to Save on Costs - track claims & benefits - check deductible balances - Using a doctor, facility, or other provider from - find a doctor the BCBS of MA network will mean a lower bill - track your medications for you. The Find a Doctor tool lets you search - view your member ID card for doctors or check to see if yours is in- - contact member services network. The SmartShopper tool offers you incentives for using the cost-effective in- network option - Get discount prescription drugs by using GoodRxto search for drugs you or your family members are prescribed to Watch: BCBS SmartShopper Tool –Get Rewarded - Make sure you’re choosing the most cost- effective option for finding care. Check out this easy guide for where to go when you’re sick or injured so you aren’t paying too much out-of-pocket member login phone support mobile app telehealth SmartShopper find a doctor glossary 7 // 2023 Employee Benefit Guide

HEALTHY ACTIONS The Wellness Program That Pays to be Healthy With Healthy Actions we make healthy living simple. We help you better understand your overall health and motivate you to set goals toward healthier you. Plus, Up to $300 In-depth Unique goals to when you take steps toward for living knowledge work toward a reaching your unique health goals , healthy about your healthier you you can earn up to $300! health Earn up to $300 Visit healthy-actions.com Just For Result Reward Being Healthy ! Your doctor has determined you have no health goals to work $300 Visa debit card on. You’ll receive the full reward – just for being healthy. OR Your doctor has noticed areas you can improve on, and has $100 Visa debit card Complete a Ask your doctor Submit your assigned you a health goal to work toward. You’ll still receive a quick online to fill out the completed partial reward, and have the chance to receive the full reward. health Healthy Actions form from your Once you’ve reached the health goal given to you by your $200 Visa debit card assessment form computer, doctor. Simply have your doctor fill out another Healthy Actions mobile device, form and send it in to receive the rest of your reward. Just be by fax, or by sure to submit your Healthy Actions form by the end of your plan mail year. 8 // 2022 Employee Benefit Guide

HEALTH SAVINGS ACCOUNT (HSA) AVAILABLE TO BCBS PPO SAVER PLAN SUBSCRIBERS 2023 Maximum Annual Eligible Expenses Plan Administrator How to Use Funds Account Owner Contribution Medical, Dental, and Vision Health Equity Use your Health Equity card You own this account. The Individuals: $3,850 at the point of sale, or funds remain there until you submit receipts for use or invest them Families: $7,750 reimbursement through the member portal HSA eligibility Watch: 5 Benefits of a Health Savings Account - You must be enrolled in the PPO Saver plan - You cannot be enrolled in another medical plan - You cannot be enrolled in Medicare or Medicaid - You cannot be claimed as a dependent on another person’s tax return - You cannot be enrolled in a general-purpose healthcare FSA plan (including through a spouse) 9 // 2022 Employee Benefit Guide

HEALTH SAVINGS ACCOUNT (HSA) AVAILABLE TO BCBS PPO SAVER PLAN SUBSCRIBERS What you need to know about your HSA You must be enrolled in Camunda’s BCBS PPO Saver plan to establish a Health Savings Account (HSA). All contributions accumulate on a tax-free basis, and can be used towards qualified medical expenses. HSAs are portable if you leave Camunda, and you own all funds remaining in the account. You can use your HSA funds by using your Health Equity debit card, making payments online, or by paying for qualified expenses up front and submitting for https://healthequity.com/start. reimbursement later at How The HSA Works Money Comes Out Money Goes In You pay the full cost of non-preventive Have Money Left? It Rolls Over! Camunda contributes $2,000 per care, including Rx until you meet your Any money left in your account is yours calendar year to individuals, and $4,000 deductible. When you have an eligible to pay for healthcare in the future or to per calendar year to families. You can expense, you can decide whether to use invest. If you leave Camunda bio, you’ll contribute up to $3,850 for individual your HSA funds or pay out of pocket. take your HSA with you – you own this plans or up to $7,700 for family plans Either way, these expenses count account. through pre-tax payroll deductions. towards your deductible and out-of- pocket maximum:

HEALTH REIMBURSEMENT ARRANGEMENT (HRA) AVAILABLE TO BCBS PPO PLAN SUBSCRIBERS The HRA is an account Employees will pay the Copays and When you do incur a that Camunda funds to first portion of their coinsurance are not deductible expense that help employees deductible, and deductible expenses, so is HRA eligible, you can enrolled in the HRA Camunda will pay the you will still have to pay submit your receipts to medical plan pay for remainder. These those when applicable. Health Equity online or expenses that apply amounts are outlined through their mobile towards their below. app. deductible. Watch: HRA the Easy Way BCBS HRA Plan You Pay Up to This Then Camunda Deductible Amount First Pays the Remaining $2,000 $250 $1,750 $4,000 $500 $3,500 11 // 2023 Employee Benefit Guide

HEALTHCARE FLEXIBLE SPENDING ACCOUNT (FSA) AVAILABLE FOR ALL EMPLOYEES TO ENROLL IN Maximum Annual Eligible Expenses Plan Administrator How to Use Funds Funds Rollover Contribution Medical, Dental, and Vision Health Equity Use your Health Equity debit You may rollover up to $3,050 card at the point of sale, or $610 of unused Healthcare submit receipts for FSA funds into the next reimbursement through the plan year member portal Enrolling in the FSA Watch: Everything You Need to Know About FSAs - You are required to enroll in the Flexible Spending Account annually to contribute to the account, per IRS regulations - Once you enroll, you will need to elect the amount you would like to contribute for the entire year - On the first day of the plan, your entire annual election is available to use - You can not contribute to an FSA and an HSA. 12 // 2022 Employee Benefit Guide

DEPENDENT CARE FLEXIBLE SPENDING ACCOUNT (DCA) AVAILABLE TO EMPLOYEES WITH ELIGIBLE DEPENDENTS Maximum Annual Eligible Expenses Plan Administrator How to Use Funds Funds Rollover Contribution Childcare and eldercare Health Equity Submit your receipts for Unused funds are $5,000 reimbursement through the forfeited at the end of the member portal plan year ($2,500 if married filing separately) Enrolling in the DCA Watch: Connecting Health and Wealth through FSAs - You are required to enroll in the Flexible Spending Account annually to contribute to the account, per IRS regulations - Once you enroll, you will need to elect the amount you would like to contribute for the entire year - Your funds are only available as they are distributed to your account from your paycheck 13 // 2022 Employee Benefit Guide

DENTAL PLAN DENTAL PPO In-Network Deductible $50/$150 Deductible waived for preventive services Out-of-Pocket Max $2,000 Preventive Care (cleanings) 100% covered Basic Care (fillings) 80% covered Major Care (crowns, dentures) 50% covered Orthodontia 50% covered for children up to lifetime max of $1,500 Deductible $50/$150 Deductible waived for preventive services 14 // 2022 Employee Benefit Guide

DENTAL PLAN EDUCATION BCBS MyBlue Member App Watch: Seeing the Dentist is Good For Your Health - track claims & benefits - check deductible balances - find a doctor - view your member ID card - contact member services scan QR learn more Your Dental Benefits - Your plan allows you two free dental - When you see a BCBS of MA network dentist, benefits cleanings a year, and one routine x- are covered at the in-network level – you will enjoy the ray every 12 months. greatest savings. Click here to find an in-network dental - All services you receive at the provider. dentist fall under preventive, basic, or major. Preventive services are fully covered even before the deductible has been met member login phone support learn more 15 // 2023 Employee Benefit Guide

VISION PLAN VSP VISION PLAN In-Network Frequency Exam $10 copay Every 12 months Frames $130 allowance with an additional 20% off Every 24 months balance Lenses Included in prescription glasses copay Every 12 months Contact Lenses $130 allowance, copay does not apply (Instead of glasses) Every 12 months Contact Lens Exam Up to $60 copay Every 12 months 16 // 2022 Employee Benefit Guide

VISION PLAN EDUCATION VSP On the Go App Watch: Reasons to Enroll in a Vision Plan - track claims & benefits - check deductible balances - find a doctor - view your member ID card - contact member services scan QR Your Vision Perks - Your plan allows you one eye exam - When you see a VSP network eye doctor, benefits are per year. This eye exam can covered at the in-network level – you will enjoy the diagnose medical issues as well as greatest savings. Click here to find an in-network vision determine a prescription for glasses provider. or contacts. - You are provided an annual allowance to spend at an in- network provider for either frames or contact lenses. member login phone support learn more 17 // 2023 Employee Benefit Guide

BASIC LIFE, VOLUNTARY LIFE & DISABILITY BASIC LIFE AND AD&D VOLUNTARY SUPPLEMENTAL LIFE AND AD&D SHORT-AND LONG-TERM DISABILITY INSURANCE INSURANCE Basic Life Coverage 1.5x your salary up to $250,000 Amount Up to $500,000 in increments of Employee $10,000 – not to exceed 5x annual salary. Short-Term Disability Long-Term Disability Coverage Guaranteed issue is $100,000 Basic AD&D 1.5x your salary up to $250,000 Coverage Amount Based on 60% of your Based on 60% of your base weekly earnings base monthly earnings Up to $150,000 in increments of $5,000 with a maximum with a maximum No medical questions asked, up –not to exceed 50% of employee’s weekly benefit up to monthly benefit up to Guaranteed issue to Guaranteed Issue amount of Spouse Coverage voluntary election. Guaranteed issue is $100 $10,000 $250,000 $30,000 Maximum benefit period up to social Up to 24 weeks security normal Age Reduction Benefit reduces to 60% at age retirement age and 70 st day Up to $10,000 in increments of $1,000 – begins on the 181 Child Coverage not to exceed 50% employee’s voluntary IRC section 79 provides an election. Guaranteed issue is $10,000 exclusion for the first $50,000 of group-term life insurance Camunda pays the Pre-existing exclusion coverage provided under a The employee must elect the benefit for remaining % of base policy carried directly or themselves in order to elect the salary while out on of 3/12 and an Disclaimer indirectly by an employer. The coverage for a spouse/partner and/or disability to make occupation duration of imputed cost of coverage in 24 months excess of $50,000 must be Requirements children. Employees pay 100% of the you whole. included in income, using the premium for this benefit. Please see the IRS Premium Table, and are information provided by Camunda for subject to social security and rates. Medicare taxes 18 // 2022 Employee Benefit Guide

401(k) RETIREMENT PLAN Watch: Setting up your Retirement Account Enrollment & Account Access You can enroll in the plan, access your account, or get more information any time by: • Logging in to the Guideline portal • Calling 1 (888) 344-5188 Monday through Friday from 6:00am –4:00pm PST. Maximum Contribution Up to $22,500 annually. You may contribute an additional $7,500 “catch-up contribution” annually if you are age 50+ Eligibility Must be 18 years of age. Eligible on Date of Hire Employer Match 100% of employee’s first 6% of contributions Plan Administrator Guideline

EMPLOYEE SUPPORT -TOUCHCARE A personal health assistant, that is available to provide free, confidential assistance on your healthcare choices. Benefit Navigation Bill Negotiation Cost Comparison Provider Search Touchcarecan assist you Send your bills to Ensure you never TouchCare will always with all aspects of TouchCare and work overpay for your care by navigate you to highly- benefits including your through anything you carefully researching all rated providers that are tax savings accounts feel is incorrect options and cost in-network and conveniently located RxCare Ancillary Benefits Benefit Refresher Questions Get assistance on finding TouchCare will help you Consult with an expert If you have any the lowest cost options leverage the right regarding your benefits questions, your Health for all your prescriptions benefit, at the right time anytime throughout the Assistance is always to save you money year there to help You can reach your Health Assistance by calling (866) 486-8242 anytime Monday – Friday from 8am –9pm EST. You can also visit the TouchCare member portal or emailing assist@touchare.com 20 // 2022 Employee Benefit Guide

PAID PARENTAL LEAVE & UNLIMITED FLEXIBLETIME OFF PARENTAL LEAVE • All active full-time employees with 6 months of service are eligible to participate • 20 Weeks of paid leave at 100% of your base salary • Both “maternity” and “paternity” leaves are covered under this policy • This leave runs concurrent with any other leave policies or statutory requirements • Please see our Parental Leave Policy for more information UNLIMITED FLEXIBLE TIME OFF (FTO) • No set number of hours and no accrual • Covers all time off including vacation, personal and sick days • Employees can take time off when they need it with manager approval • Any absences greater than 20 consecutive days are considered a leave of Absence • Please see our Unlimited Flexible Time Off Policy for more information 21 // 2022 Employee Benefit Guide

EMPLOYEE ASSISTANCE PROGRAM EAP Confidential Counseling on Get confidential counseling by personal issues experienced clinicians over the phone 24 hours a day, seven day a week Financial issues can arise at any time, from dealing with debt to saving for retirement. Our financial professionals are here to Financial Information discuss your concerns and provide you with the tools and information you need to address your finances including getting out of debt, retirement, tax questions and You are automatically enrolled in the Camunda more EAP . This benefit is provided by SunLife Insurance When a legal issue arises, our attorneys are through ComPsych. Legal information available to provide confidential support with practical, understandable information and assistance. To get help call (800) 460-4374 or visit: guidanceresources.com –using the WEBID: Access expert information to assist you EAPessential Online Information with the issues that matter to you, from personal or family concerns to legal and financial concerns. 22 // 2022 Employee Benefit Guide

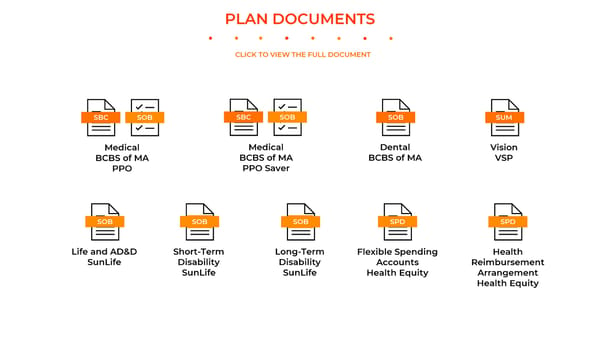

PLAN DOCUMENTS CLICK TO VIEW THE FULL DOCUMENT SBC SOB SBC SOB SOB SUM Medical Medical Dental Vision BCBS of MA BCBS of MA BCBS of MA VSP PPO PPO Saver SOB SOB SOB SPD SPD Life and AD&D Short-Term Long-Term Flexible Spending Health SunLife Disability Disability Accounts Reimbursement SunLife SunLife Health Equity Arrangement Health Equity

HEALTH PLAN NOTICES Affordable Care Act Patient Protections comply with certain procedures, including obtaining prior authorization for certain services, following a pre-approved (a.) Coverage for Children Up to Age of 26 treatment plan, or procedures for making referrals. For a list of participating health care professionals who specialize The Affordable Care Act of 2010 requires that the Plan must make dependent coverage available to adult children until in obstetrics or gynecology, contact the Plan administrator or Insurer. they turn 26 regardless if they are married, a dependent, or a student. (h) Emergency Services (b.) Notice Regarding Lifetime and Annual Dollar Limits If the group health plan provides benefits for “emergency services,” the plan must cover the services subject to a In accordance with the Affordable Care Act, any lifetime dollar limits and annual dollar limits set forth in the Plan shall number of conditions, as described below: Emergency services include both of the following: not apply to “essential health benefits,” as such term is defined under the ACA. The law defines “essential health 1. Initial services. A medical screening examination within the capability of a hospital emergency department or benefits” to include, at minimum, items and services covered within certain categories including emergency services, freestanding independent emergency department, including ancillary services routinely available in the emergency hospitalization, prescription drugs, rehabilitative and habilitative services and devices, and laboratory services. A department, to determine whether an “emergency medical condition” exists. determination as to whether a benefit constitutes an “essential health benefit” will be based on a good faith 2. Post-stabilization services. Additional services covered under the plan that are furnished by a nonparticipating interpretation by the Plan Administrator of the guidance available as of the date on which the determination is made. provider or nonparticipating emergency facility after a participant or beneficiary is stabilized and as part of outpatient observation or an inpatient or outpatient stay with respect to the visit in which the initial services were provided.23.1 (c.) Your Health Insurance Cannot be Rescinded An emergency medical condition is a medical condition, including a mental health condition or substance use disorder, The Affordable Care Act of 2010 prohibits the Plan, or any insurer, from rescinding your health insurance coverage manifesting itself through acute symptoms of sufficient severity that a prudent layperson with an average knowledge except as permitted under the Act. of health and medicine could reasonably expect the absence of immediate medical attention to place the individual’s health in serious jeopardy, impair bodily functions, or result in serious dysfunction of bodily organ or part. The services (d.) Prohibition of Pre Existing Conditions must be covered without the need for any prior authorization, even if provided out-of-network. No insurance plan can reject you, charge you more, or refuse to pay for essential health benefits for any condition you had before your coverage started. (i.) Continuity of Care When a provider ceases to be an in-network provider during an ongoing course of treatment --if an individual is (e.)Prohibition of Restrictions on Annual Limits on Essential Benefits covered under a group health plan with respect to an in-network health care provider or facility and such individual is The Affordable Care Act of 2010 prohibits the Plan, or any insurer, effective January 1, 2014 from placing annual limits a “continuing care patient” with respect to such provider or facility, the plan must provide notice to the individual, and on the value of essential health benefits. potentially provide transitional care for up to 90 days, if— 1. the contractual relationship between the plan and provider or facility is “terminated”; (f.) Mental Health Parity Act 2. benefits provided under the plan with respect to the provider or facility are terminated because of a change in The Mental Health Parity Act of 1996 (MHPA) provided that large group health plans cannot impose annual or lifetime the terms of the participation of such provider or facility in the plan; or dollar limits on mental health benefits that are less favorable than any such limits imposed on medical/surgical 3. a contract between the plan and a health insurance issuer offering health insurance coverage in connection with benefits. MHPAEA preserves the MHPA protections and adds significant new protections, such as extending the parity the plan is terminated, resulting in a loss of benefits provided under the plan with respect to the provider or requirements to substance use disorders. The Affordable Care Act builds on MHPAEA and requires coverage of mental facility. health and substance use disorder services as one of ten Essential Health Benefits categories in non-grandfathered individual and small group plans. Family and Medical Leave Act (FMLA) (g) Right to designate a provider. If the Company and employee (you) are covered under the federal Family and Medical Leave Act (FMLA), the you can The group medical plan generally requires/allows the designation of a primary care provider. You have the right to take up to 12 weeks of unpaid leave during a 12-month period for one or more of the following reasons: designate any primary care provider who participates in our network and who is available to accept you or your family • for the birth and care of the newborn child of the employee; members. If the plan designates a primary care provider automatically, until you make this designation, the Plan • for placement with the employee of a son or daughter for adoption or foster care; designates one for you. For information on how to select a primary care provider, and for a list of the participating • to care for an immediate family member (spouse, child, or parent) with a serious health condition; or primary care providers, contact the Plan administrator or insurer. For children, you may designate a pediatrician as the • to take medical leave when the employee is unable to work because of a serious health condition. primary care provider. You do not need prior authorization from the Medical Plan or from any other person (including a primary care provider) in order to obtain access to obstetrical or gynecological care from a health care professional in our network who specializes in obstetrics or gynecology. The health care professional, however, may be required to

HEALTH PLAN NOTICES If you are covered by FMLA, you will have certain rights to maintain health benefits during the FMLA leave. You will be Medicare Prescription Drug Plan Information – Creditable Coverage notified of any requirement for you to make any premium payments to maintain health benefits and the arrangements for making such payments along with the possible consequences of failure to make such payments on a Important Notice About Your Prescription Drug Coverage Under the Company Group timely basis (i.e., the circumstances under which coverage may lapse) and your potential liability for payment of health insurance premiums paid by the employer during your unpaid FMLA leave if you fail to return to work after Health Plan and Medicare Prescription Drug Coverage: This notice is applicable to the taking FMLA leave. For more information about FMLA, contact the Plan administrator. Company employees eligible for medical plan coverage and who have Medicare or will Genetic Information Nondiscrimination Act (GINA) become eligible for Medicare in the Next 12 Months. This notice is applicable to Medicare eligible participants ONLY. If you or one of your covered dependents is not The Genetic Information Nondiscrimination Act of 2008 (GINA) prohibits employers and other entities covered by Medicare eligible or will not be within the next 12 months, you can disregard this notice. GINA from requesting or requiring genetic information of an individual or family member of the individual, except as specifically allowed by this law. To comply with this law, we are asking that you not provide any genetic information when responding to this request. “Genetic information” as defined by GINA, includes an individual’s family medical This notice has information about your current prescription drug coverage under the history, the results of an individual’s or family member’s genetic tests, the fact that an individual or an individual’s group health plan coverage offered by the Company Group Health Plan (Plan) and about family member sought or received genetic services, and genetic information of a fetus carried by an individual or an your options under Medicare’s prescription drug coverage. This information can help you individual’s family member or an embryo lawfully held by an individual or family member receiving assistive reproductive services. Please do not include any family medical history or any information related to genetic testing, decide whether or not you want to join a Medicare drug plan. If you are considering genetic services, genetic counseling or genetic diseases for which an individual may be at risk. joining, you should compare your current coverage, including which drugs are covered at Grandfathered Status what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions The Plan believes that none of the group health plans available under the Plan are “grandfathered health plans” as about your prescription drug coverage is at the end of this notice. described under the Affordable Care Act. HIPAA Special Enrollment Rights There are two important things you need to know about your current coverage under If you are declining enrollment for yourself or your dependents (including your spouse) because of other health the Company Plan and Medicare’s prescription drug coverage: insurance or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage(or if the employer stops contributing toward your or your 1. Medicare prescription drug coverage is available to everyone with Medicare. You can dependents’ other coverage). However, you must request enrollment within 30 days after your or your dependents’ get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare other coverage ends (or after the employer stops contributing toward the other coverage). In addition, if you have a Advantage Plan (like an HMO or PPO) that offers prescription drug coverage. This new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents. However, you must request enrollment within 30 days after the marriage, birth, adoption, or coverage is sometimes referred to as Medicare Part D prescription drug coverage. In placement for adoption. To request special enrollment or obtain more information, contact the Plan Administrator. general, Medicare Part D provides coverage for prescription drugs not covered under Medicare Part A and Part B. All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

HEALTH PLAN NOTICES 2. The Company has determined that the prescription drug coverage offered by the 3. You may reject all coverage under the Company Plan and choose coverage under Plan is, on average for all plan participants, expected to pay out as much as what Medicare as your primary and only payer for all medical and prescription drug standard Medicare prescription drug coverage pays and is therefore considered expenses. If you do so, you will not be able to receive coverage under the Company CREDITABLE Coverage. Because your existing coverage is Creditable Coverage, you Plan, including prescription drug coverage, unless and until you are eligible to reenroll can keep this coverage and not pay a higher premium (a penalty) if you later decide at the next enrollment period for which you are eligible, if any. Your current coverage to join a Medicare drug plan. pays for other types of health expenses, in addition to prescription drugs, and you will not be eligible to receive any of your current health and prescription drug benefits if When Can You Join A Medicare Drug Plan? you reject coverage under the Company Plan and choose to enroll in Medicare, You can join a Medicare drug plan when you first become eligible for Medicare and each including a Medicare prescription drug plan, as your primary and only payer. year from October 15 through December 7. However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a When Will You Pay a Higher Premium (Penalty) to Join a Medicare Drug Plan? two-month Special Enrollment Period (SEP) to join a Medicare drug plan. You should also know that if you drop or lose your current prescription drug coverage with the Plan and don’t join a Medicare drug plan within 63 continuous days after your What Happens to Your Current Coverage If You Decide to Join A Medicare Drug Plan? current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug Plan Participants who also are eligible for Medicare have the following three options plan later. If you go 63 continuous days or longer without creditable prescription drug concerning prescription drug coverage: coverage, your monthly premium may go up by at least 1% of the Medicare base 1. You may stay in the Plan and not enroll in the Medicare prescription drug coverage at beneficiary premium per month for every month that you did not have that coverage. For this time. You will be able to enroll in the Medicare prescription drug coverage at a example, if you go 19 months without creditable coverage, your premium may later date without penalty, either (1) during a Medicare prescription drug open consistently be at least 19% higher than the Medicare base beneficiary premium. You enrollment period (October 15–December 7 of each year); or (2) if you lose Plan may have to pay this higher premium (a penalty) so long as you have Medicare coverage. This is the best option for most Plan participants who are eligible for prescription drug coverage. In addition, you may have to wait until the following October Medicare. to join. 2. You may stay in the Plan and also enroll in Medicare prescription drug coverage at this time. The Plan will pay prescription drug benefits as the primary payer in most For More Information About This Notice or Your Current Prescription Drug Coverage… instances. Medicare will pay benefits as a secondary payer, and thus the value of Contact the Corporate Benefits Department for further information. NOTE: You’ll get this your Medicare prescription drug coverage will be greatly reduced. Your current notice each year. You will also get it before the next period you can join a Medicare drug coverage under the Plan pays for other health benefits as well as prescription drugs plan, and if this coverage through the Plan changes. You also may request a copy of this and will not change if you choose to enroll in Medicare prescription drug coverage. notice at any time.

HEALTH PLAN NOTICES For More Information About Your Options Under Medicare Prescription Drug mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her Coverage… newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in More detailed information about Medicare plans that offer prescription drug coverage is excess of 48 hours (or 96 hours). in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every Notice of Marketplace/Exchange year from Medicare. You may also be contacted directly by Medicare drug plans. You have the option to purchase health insurance at the Health Insurance Marketplace. The Marketplace offers "one- For more information about Medicare prescription drug coverage: stop shopping" to find and compare private health insurance options as well as a premium tax credit or a cost sharing 1. Visit www.medicare.gov reduction for certain qualified individuals. Employer contributions to employer-provided coverage may be excludable for federal income tax purposes. If you purchase a health plan through the Marketplace, you may lose any employer 2. Call your State Health Insurance Assistance Program (see the inside back cover of contribution toward the cost of your health coverage. The Marketplace can help you evaluate your coverage options, your copy of the “Medicare & You” handbook for their telephone number) for including your eligibility for coverage through the Marketplace and its cost. Please visit www.Healthcare.gov for more personalized help. Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1- information and contact information for a Health Insurance Marketplace in your area. 877-486-2048. Qualified Medical Child Support Orders (QMCSOs) 3. If you have limited income and resources, extra help paying for Medicare A QMCSO is a judgment, decree, or order, issued by a court or through a state administrative process, that requires prescription drug coverage is available. For information about this extra help, visit health plan coverage for the child of a participant (called an “alternate recipient”) and that meets certain legal Social Security on the web at www.ssa.gov, or call them at 1-800-772-1213 (TTY 1- requirements. Such orders typically are issued as part of a divorce or as part of a state child support order proceeding. 800-325-0778). A QMCSO may apply to an employer's major medical plan, as well as to other types of group health plans such as dental plans, vision plans, and health FSAs. In general, a child who is an alternate recipient under a QMCSO must be treated the same as any other child covered by the plan. Plans are not required to provide coverage in accordance with a child Michelle’s Law support order or other court order unless the order is “qualified” in accordance with ERISA §609(a). The Plan Administrator has the authority to determine whether an order meets the requirements of ERISA §609(a). If the order Pursuant to Michelle’s Law, the Company group health plan provides dependent coverage beyond age 26 and bases does not meet these requirements, the Plan need not (and should not) provide any benefits to the alternate recipient, eligibility for such dependent coverage on student status. When a dependent child loses student status for purposes unless the child is otherwise eligible for and enrolled in the Plan or the order's deficiencies are corrected by the parties. of the Company group health plan coverage as a result of a medically necessary leave of absence from a post- secondary educational institution, the Company group health plan will continue to provide coverage during the leave Uniformed Services Employment and Reemployment Rights Act (USERRA) Notice of right to elect continuation of absence for up to one year, or until coverage would otherwise terminate under the Company group health plan, coverage under USERRA. whichever is earlier. In order to be eligible to continue coverage as a dependent during such leave of absence, the Company group health plan must receive written certification by a treating physician of the dependent child which The Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA) established requirements that states that the child is suffering from a serious illness or injury and that the leave of absence (or other change of employers must meet for certain employees who are involved in the uniformed services. In addition to the rights that enrollment) is medically necessary; and the child must be enrolled in the plan immediately prior to the first day of the you have under COBRA, you (the employee) are entitled under USERRA to continue the coverage that you (and your medically necessary leave of absence. To obtain additional information, please contact the Plan Administrator. covered dependents, if any) had under the company Medical Plan, the Dental Plan, and/or the company Health FSA (the “Company Plans”). Your rights as an employee under COBRA and USERRA are similar but not identical. The election Newborn’s and Mothers’ Health Protection Act for Maternity and Infant Coverage for continuation coverage under the Company Plans that you, the employee, make pursuant to COBRA will also be considered your election under USERRA for you and your covered dependents. Thus, USERRA will apply with respect to Group health plans and health insurance issuers generally may not, under federal law, restrict benefits for any hospital the COBRA continuation coverage elected by you and any COBRA continuation coverage elected by your covered length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal dependents. Continuation coverage under both statutes will run concurrently (at the same time), so that, for example, delivery, or less than 96 hours following a cesarean section. However, federal law generally does not prohibit the when your (or your covered dependent’s) first 18 months of concurrent COBRA and USERRA continuation coverage

HEALTH PLAN NOTICES ends, you (or your covered dependent) will have up to an additional six months of continuation coverage under You are protected from balance billing for: USERRA. Emergency services If you have continuation rights under both laws for the Company Health Plans, instead of making this combined If you have an emergency medical condition and get emergency services from an out-ofnetwork provider or facility, COBRA and USERRA election: (1) you may make an election under only COBRA; or (2) you may make an election under the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and only USERRA. For information about how to make a USERRA-only or COBRA-only election, consult the Plan coinsurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re Administrator. in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services. Wellness Program Disclosure Certain services at an in-network hospital or ambulatory surgical center Your health plan is committed to helping you achieve your best health. If a Wellness Program is offered, rewards for When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out- participating in a wellness program are available to all employees. If you think you might be unable to meet a standard of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This for a reward under the wellness program, you might qualify for an opportunity to earn the same reward by different applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, means. Contact the Plan Administrator and we will work with you (and, if you wish, with your doctor) to find a hospitalist, or intensivist services. These providers can’t balance bill you and may not ask you to give up your wellness program with the same reward that is right for you in light of your health status. protections not to be balance billed. If you get other services at these in-network facilities, out-of-network providers can’t balance bill you, unless you give written consent and give up your protections. Women’s Health and Cancer Rights Act (WHCRA) You’re never required to give up your protections from balance billing. You also aren’t required to get care out-of- If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Women's Health network. You can choose a provider or facility in your plan’s network. and Cancer Rights Act of 1998 (WHCRA). For individuals receiving mastectomy-related benefits, coverage will be When balance billing isn’t allowed, you also have the following protections: provided in a manner determined in consultation with the attending physician and the patient, for all stages of You are only responsible for paying your share of the cost (like the copayments, coinsurance, and deductibles that you reconstruction of the breast on which the mastectomy was performed, surgery and reconstruction of the other breast would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities to produce a symmetrical appearance, prostheses, and treatment of physical complications of the mastectomy, directly. including lymphedema. These benefits will be provided subject to the same deductibles and co-insurance applicable Your health plan generally must: to other medical and surgical benefits provided under the Company Health Plan. If you would like more information 1. Cover emergency services without requiring you to get approval for services in advance (prior authorization). on WHCRA benefits, please call your Plan Administrator. 2. Cover emergency services by out-of-network providers. Your Rights and Protections Against Surprise Medical Bills 3. Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits. When you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory 4. Count any amount you pay for emergency services or out-of-network services toward your deductible and out-of- surgical center, you are protected from surprise billing or balance billing. pocket limit. What is “balance billing” (sometimes called “surprise billing”)? If you believe you’ve been wrongly billed, you may contact the Plan Administrator or you may contact the Centers for When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, such as a copayment, Medicare & Medicaid Services https://www.cms.gov/nosurprises. Visit https://www.cms.gov/nosurprises/Policies- coinsurance, and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a and-Resources/Overview-of-rules-fact-sheets for more information about your rights under federal law. health care facility that isn’t in your health plan’s network. “Out-of-network” describes providers and facilities that haven’t signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit. “Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

HEALTH PLAN NOTICES Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP) ALABAMA –Medicaid CALIFORNIA –Medicaid Website: http://myalhipp.com/ Website: If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, Phone: 1-855-692-5447 Health Insurance Premium Payment (HIPP) Program your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or http://dhcs.ca.gov/hipp CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium Phone: 916-445-8322 assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Fax: 916-440-5676 Marketplace. For more information, visit www.healthcare.gov. Email: hipp@dhcs.ca.gov If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your ALASKA –Medicaid COLORADO –Health First Colorado (Colorado’s Medicaid State Medicaid or CHIP office to find out if premium assistance is available. Program) & Child Health Plan Plus (CHP+) If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your The AK Health Insurance Premium Payment Program Health First Colorado Website: dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877- Website: http://myakhipp.com/ https://www.healthfirstcolorado.com/ KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that Phone: 1-866-251-4861 Health First Colorado Member Contact Center: might help you pay the premiums for an employer-sponsored plan. Email: CustomerService@MyAKHIPP.com 1-800-221-3943/ State Relay 711 CHP+: Medicaid Eligibility: https://www.colorado.gov/pacific/hcpf/child-health- If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your https://health.alaska.gov/dpa/Pages/default.aspx plan-plus employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is CHP+ Customer Service: 1-800-359-1991/ State Relay 711 called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible Health Insurance Buy-In Program for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of (HIBI): https://www.colorado.gov/pacific/hcpf/health- Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272). insurance-buy-program To see if any other states have added a premium assistance program since July 31, 2022, or for more information on HIBICustomer Service: 1-855-692-6442 special enrollment rights, contact either: U.S. Department of Labor S U.S. Department of Health and Human Services ARKANSAS –Medicaid FLORIDA –Medicaid Employee Benefits Security Administration Centers for Medicare & Medicaid Services Website: www.dol.gov/agencies/ebsa www.cms.hhs.gov http://myarhipp.com/ Website: 1-866-444-EBSA (3272) 1-877-267-2323, Menu Option 4, Ext. 61565 Phone: 1-855-MyARHIPP (855-692-7447) https://www.flmedicaidtplrecovery.com/flmedicaidtplreco very.com/hipp/index.html ________________________________________________________________________________________________ Phone: 1-877-357-3268 If you live in one of the following states, you may be eligible for assistance paying your employer health plan GEORGIA –Medicaid MASSACHUSETTS –Medicaid and CHIP premiums. The following list of states is current as of July 31, 2022. Contact your State for more information on GA HIPP Website: https://medicaid.georgia.gov/health- https://www.mass.gov/masshealth/pa eligibility – Website: insurance-premium-payment-program-hipp Phone: 1-800-862-4840 Phone: 678-564-1162, Press 1 TTY: (617) 886-8102 GA CHIPRA Website: https://medicaid.georgia.gov/programs/third-party- liability/childrens-health-insurance-program- reauthorization-act-2009-chipra Phone: (678) 564-1162, Press 2

HEALTH PLAN NOTICES INDIANA –Medicaid MINNESOTA –Medicaid LOUISIANA –Medicaid NEVADA –Medicaid Healthy Indiana Plan for low-income adults 19-64 Website: Website: Medicaid Website: www.medicaid.la.govor http://dhcfp.nv.gov Website: http://www.in.gov/fssa/hip/ https://mn.gov/dhs/people-we-serve/children-and- www.ldh.la.gov/lahipp Medicaid Phone: 1-800-992-0900 Phone: 1-877-438-4479 families/health-care/health-care-programs/programs- Phone: 1-888-342-6207 (Medicaid hotline) or 1-855- All other Medicaid and-services/other-insurance.jsp 618-5488 (LaHIPP) Website: https://www.in.gov/medicaid/ Phone: 1-800-657-3739 MAINE –Medicaid NEW HAMPSHIRE –Medicaid Phone 1-800-457-4584 Enrollment Website: Website: https://www.dhhs.nh.gov/programs- IOWA –Medicaid and CHIP (Hawki) MISSOURI –Medicaid https://www.maine.gov/dhhs/ofi/applications-forms services/medicaid/health-insurance-premium-program Medicaid Website: Website: Phone: 1-800-442-6003 Phone: 603-271-5218 https://dhs.iowa.gov/ime/members http://www.dss.mo.gov/mhd/participants/pages/hipp. TTY: Maine relay 711 Toll free number for the HIPP program: 1-800-852-3345, Medicaid Phone: 1-800-338-8366 htm ext 5218 Hawki Website: Phone: 573-751-2005 Private Health Insurance Premium Webpage: http://dhs.iowa.gov/Hawki https://www.maine.gov/dhhs/ofi/applications-forms Hawki Phone: 1-800-257-8563 Phone: -800-977-6740. HIPP Website: TTY: Maine relay 711 https://dhs.iowa.gov/ime/members/medicaid-a-to- z/hipp NEW JERSEY –Medicaid and CHIP SOUTH DAKOTA -Medicaid Medicaid Website: http://dss.sd.gov HIPP Phone: 1-888-346-9562 Website: KANSAS –Medicaid MONTANA –Medicaid http://www.state.nj.us/humanservices/ Phone: 1-888-828-0059 Website: https://www.kancare.ks.gov/ Website: dmahs/clients/medicaid/ Phone: 1-800-792-4884 http://dphhs.mt.gov/MontanaHealthcarePrograms/HI Medicaid Phone: 609-631-2392 PP CHIP Website: Phone: 1-800-694-3084 http://www.njfamilycare.org/index.html Email: HHSHIPPProgram@mt.gov CHIP Phone: 1-800-701-0710 KENTUCKY –Medicaid NEBRASKA –Medicaid NEW YORK –Medicaid TEXAS –Medicaid Kentucky Integrated Health Insurance Premium Website: http://www.ACCESSNebraska.ne.gov Website: Website: http://gethipptexas.com/ Payment Program (KI-HIPP) Website: Phone: 1-855-632-7633 https://www.health.ny.gov/health_care/medicaid/ Phone: 1-800-440-0493 https://chfs.ky.gov/agencies/dms/member/Pages/kihip Lincoln: 402-473-7000 Phone: 1-800-541-2831 p.aspx Omaha: 402-595-1178 NORTH CAROLINA –Medicaid UTAH –Medicaid and CHIP Phone: 1-855-459-6328 Website: https://medicaid.ncdhhs.gov/ Medicaid Website: https://medicaid.utah.gov/ Email: KIHIPP.PROGRAM@ky.gov Phone: 919-855-4100 CHIP Website: http://health.utah.gov/chip Phone: 1-877-543-7669 KCHIP Website: NORTH DAKOTA –Medicaid VERMONT–Medicaid https://kidshealth.ky.gov/Pages/index.aspx Website: Website: http://www.greenmountaincare.org/ Phone: 1-877-524-4718 http://www.nd.gov/dhs/services/medicalserv/medica Phone: 1-800-250-8427 Kentucky Medicaid Website: https://chfs.ky.gov id/ Phone: 1-844-854-4825

HEALTH PLAN NOTICES OKLAHOMA –Medicaid and CHIP VIRGINIA –Medicaid and CHIP Website: http://www.insureoklahoma.org Website: https://www.coverva.org/en/famis-select Phone: 1-888-365-3742 https://www.coverva.org/en/hipp Medicaid Phone: 1-800-432-5924 CHIP Phone: 1-800-432-5924 OREGON –Medicaid WASHINGTON –Medicaid Website: Website: https://www.hca.wa.gov/ http://healthcare.oregon.gov/Pages/index.aspx Phone: 1-800-562-3022 http://www.oregonhealthcare.gov/index-es.html Phone: 1-800-699-9075 PENNSYLVANIA –Medicaid WEST VIRGINIA –Medicaid and CHIP Website: Website: https://dhhr.wv.gov/bms/ https://www.dhs.pa.gov/Services/Assistance/Pages/H http://mywvhipp.com/ IPP-Program.aspx Medicaid Phone: 304-558-1700 Phone: 1-800-692-7462 CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699- 8447) RHODE ISLAND –Medicaid and CHIP WISCONSIN –Medicaid and CHIP Website: http://www.eohhs.ri.gov/ Website: Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte https://www.dhs.wisconsin.gov/badgercareplus/p- Share Line) 10095.htm Phone: 1-800-362-3002 SOUTH CAROLINA –Medicaid WYOMING –Medicaid Website: https://www.scdhhs.gov Website: Phone: 1-888-549-0820 https://health.wyo.gov/healthcarefin/medicaid/progr ams-and-eligibility/ Phone: 1-800-251-1269