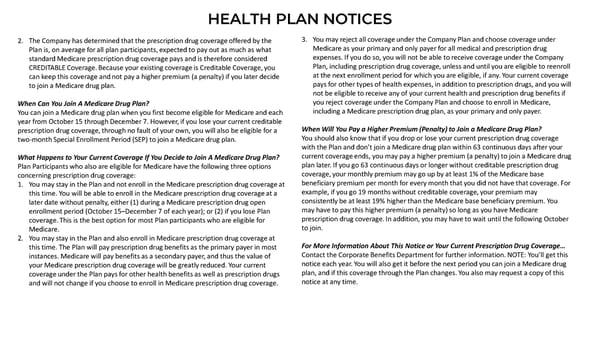

HEALTH PLAN NOTICES 2. The Company has determined that the prescription drug coverage offered by the 3. You may reject all coverage under the Company Plan and choose coverage under Plan is, on average for all plan participants, expected to pay out as much as what Medicare as your primary and only payer for all medical and prescription drug standard Medicare prescription drug coverage pays and is therefore considered expenses. If you do so, you will not be able to receive coverage under the Company CREDITABLE Coverage. Because your existing coverage is Creditable Coverage, you Plan, including prescription drug coverage, unless and until you are eligible to reenroll can keep this coverage and not pay a higher premium (a penalty) if you later decide at the next enrollment period for which you are eligible, if any. Your current coverage to join a Medicare drug plan. pays for other types of health expenses, in addition to prescription drugs, and you will not be eligible to receive any of your current health and prescription drug benefits if When Can You Join A Medicare Drug Plan? you reject coverage under the Company Plan and choose to enroll in Medicare, You can join a Medicare drug plan when you first become eligible for Medicare and each including a Medicare prescription drug plan, as your primary and only payer. year from October 15 through December 7. However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a When Will You Pay a Higher Premium (Penalty) to Join a Medicare Drug Plan? two-month Special Enrollment Period (SEP) to join a Medicare drug plan. You should also know that if you drop or lose your current prescription drug coverage with the Plan and don’t join a Medicare drug plan within 63 continuous days after your What Happens to Your Current Coverage If You Decide to Join A Medicare Drug Plan? current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug Plan Participants who also are eligible for Medicare have the following three options plan later. If you go 63 continuous days or longer without creditable prescription drug concerning prescription drug coverage: coverage, your monthly premium may go up by at least 1% of the Medicare base 1. You may stay in the Plan and not enroll in the Medicare prescription drug coverage at beneficiary premium per month for every month that you did not have that coverage. For this time. You will be able to enroll in the Medicare prescription drug coverage at a example, if you go 19 months without creditable coverage, your premium may later date without penalty, either (1) during a Medicare prescription drug open consistently be at least 19% higher than the Medicare base beneficiary premium. You enrollment period (October 15–December 7 of each year); or (2) if you lose Plan may have to pay this higher premium (a penalty) so long as you have Medicare coverage. This is the best option for most Plan participants who are eligible for prescription drug coverage. In addition, you may have to wait until the following October Medicare. to join. 2. You may stay in the Plan and also enroll in Medicare prescription drug coverage at this time. The Plan will pay prescription drug benefits as the primary payer in most For More Information About This Notice or Your Current Prescription Drug Coverage… instances. Medicare will pay benefits as a secondary payer, and thus the value of Contact the Corporate Benefits Department for further information. NOTE: You’ll get this your Medicare prescription drug coverage will be greatly reduced. Your current notice each year. You will also get it before the next period you can join a Medicare drug coverage under the Plan pays for other health benefits as well as prescription drugs plan, and if this coverage through the Plan changes. You also may request a copy of this and will not change if you choose to enroll in Medicare prescription drug coverage. notice at any time.

Camunda 2023 Employee Benefit Guide Page 25 Page 27

Camunda 2023 Employee Benefit Guide Page 25 Page 27