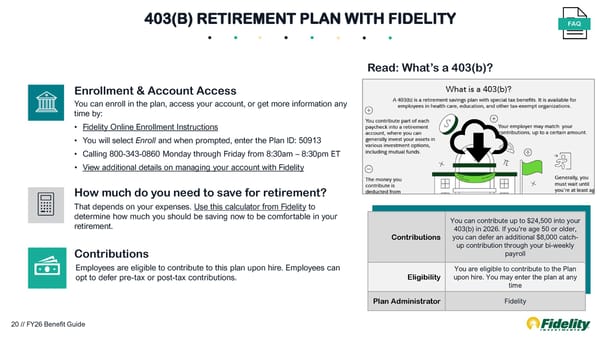

Enrollment & Account Access You can enroll in the plan, access your account, or get more information any time by: • Fidelity Online Enrollment Instructions • You will select Enroll and when prompted, enter the Plan ID: 50913 • Calling 800-343-0860 Monday through Friday from 8:30am – 8:30pm ET • View additional details on managing your account with Fidelity How much do you need to save for retirement? That depends on your expenses. Use this calculator from Fidelity to determine how much you should be saving now to be comfortable in your retirement. Read: What’s a 403(b)? Contributions Employees are eligible to contribute to this plan upon hire. Employees can opt to defer pre-tax or post-tax contributions. 403(B) RETIREMENT PLAN WITH FIDELITY FAQ Contributions You can contribute up to $24,500 into your 403(b) in 2026. If you’re age 50 or older, you can defer an additional $8,000 catch- up contribution through your bi-weekly payroll Eligibility You are eligible to contribute to the Plan upon hire. You may enter the plan at any time Plan Administrator Fidelity 20 // FY26 Benefit Guide

FY26 Benefit Guide Page 19 Page 21

FY26 Benefit Guide Page 19 Page 21