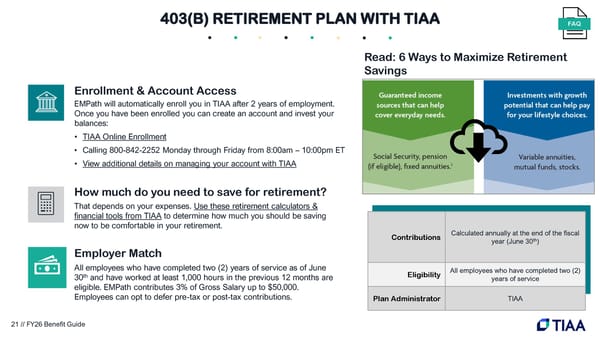

Contributions Calculated annually at the end of the fiscal year (June 30th) Eligibility All employees who have completed two (2) years of service Plan Administrator TIAA Enrollment & Account Access EMPath will automatically enroll you in TIAA after 2 years of employment. Once you have been enrolled you can create an account and invest your balances: • TIAA Online Enrollment • Calling 800-842-2252 Monday through Friday from 8:00am – 10:00pm ET • View additional details on managing your account with TIAA How much do you need to save for retirement? That depends on your expenses. Use these retirement calculators & financial tools from TIAA to determine how much you should be saving now to be comfortable in your retirement. Employer Match All employees who have completed two (2) years of service as of June 30th and have worked at least 1,000 hours in the previous 12 months are eligible. EMPath contributes 3% of Gross Salary up to $50,000. Employees can opt to defer pre-tax or post-tax contributions. 403(B) RETIREMENT PLAN WITH TIAA FAQ Read: 6 Ways to Maximize Retirement Savings 21 // FY26 Benefit Guide

FY26 Benefit Guide Page 20 Page 22

FY26 Benefit Guide Page 20 Page 22