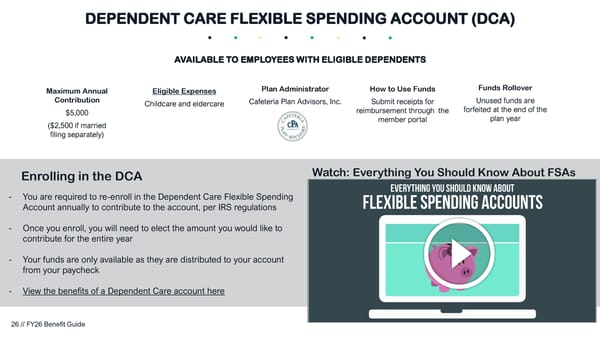

Enrolling in the DCA Watch: Everything You Should Know About FSAs - You are required to re-enroll in the Dependent Care Flexible Spending Account annually to contribute to the account, per IRS regulations - Once you enroll, you will need to elect the amount you would like to contribute for the entire year - Your funds are only available as they are distributed to your account from your paycheck - View the benefits of a Dependent Care account here Maximum Annual Contribution $5,000 ($2,500 if married filing separately) Eligible Expenses Childcare and eldercare Plan Administrator Cafeteria Plan Advisors, Inc. How to Use Funds Submit receipts for reimbursement through the member portal Funds Rollover Unused funds are forfeited at the end of the plan year DEPENDENT CARE FLEXIBLE SPENDING ACCOUNT (DCA) AVAILABLE TO EMPLOYEES WITH ELIGIBLE DEPENDENTS 26 // FY26 Benefit Guide

FY26 Benefit Guide Page 25 Page 27

FY26 Benefit Guide Page 25 Page 27