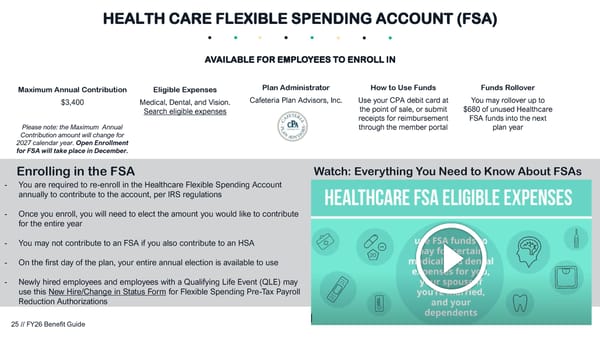

Enrolling in the FSA Watch: Everything You Need to Know About FSAs - You are required to re-enroll in the Healthcare Flexible Spending Account annually to contribute to the account, per IRS regulations - Once you enroll, you will need to elect the amount you would like to contribute for the entire year - You may not contribute to an FSA if you also contribute to an HSA - On the first day of the plan, your entire annual election is available to use - Newly hired employees and employees with a Qualifying Life Event (QLE) may use this New Hire/Change in Status Form for Flexible Spending Pre-Tax Payroll Reduction Authorizations Maximum Annual Contribution $3,400 Please note: the Maximum Annual Contribution amount will change for 2027 calendar year. Open Enrollment for FSA will take place in December. Eligible Expenses Medical, Dental, and Vision. Search eligible expenses How to Use Funds Use your CPA debit card at the point of sale, or submit receipts for reimbursement through the member portal Funds Rollover You may rollover up to $680 of unused Healthcare FSA funds into the next plan year Plan Administrator Cafeteria Plan Advisors, Inc. HEALTH CARE FLEXIBLE SPENDING ACCOUNT (FSA) AVAILABLE FOR EMPLOYEES TO ENROLL IN 25 // FY26 Benefit Guide

FY26 Benefit Guide Page 24 Page 26

FY26 Benefit Guide Page 24 Page 26