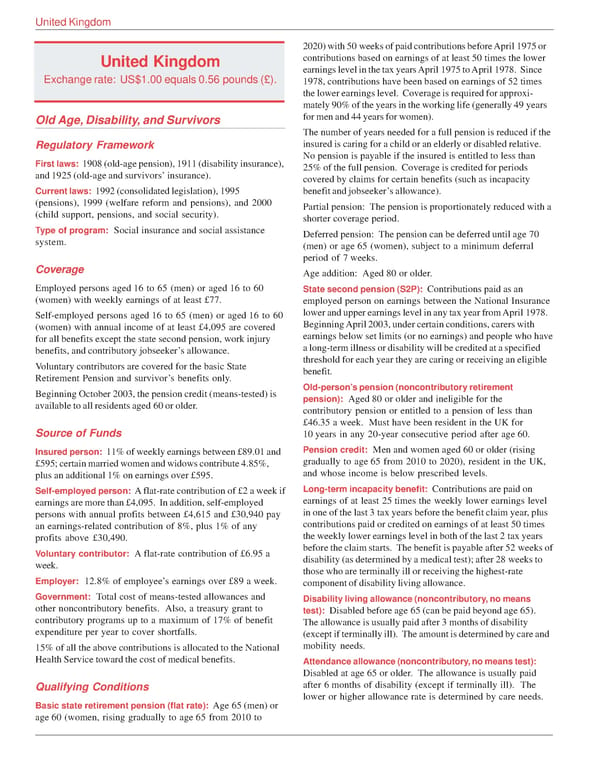

United Kingdom 2020) with 50 weeks of paid contributions before April 1975 or United Kingdom contributions based on earnings of at least 50 times the lower Exchange rate: US$1.00 equals 0.56 pounds (£). earnings level in the tax years April 1975 to April 1978. Since 1978, contributions have been based on earnings of 52 times the lower earnings level. Coverage is required for approxi- mately 90% of the years in the working life (generally 49 years Old Age, Disability, and Survivors for men and 44 years for women). The number of years needed for a full pension is reduced if the Regulatory Framework insured is caring for a child or an elderly or disabled relative. First laws: 1908 (old-age pension), 1911 (disability insurance), No pension is payable if the insured is entitled to less than and 1925 (old-age and survivors’ insurance). 25% of the full pension. Coverage is credited for periods covered by claims for certain benefits (such as incapacity Current laws: 1992 (consolidated legislation), 1995 benefit and jobseeker’s allowance). (pensions), 1999 (welfare reform and pensions), and 2000 Partial pension: The pension is proportionately reduced with a (child support, pensions, and social security). shorter coverage period. Type of program: Social insurance and social assistance Deferred pension: The pension can be deferred until age 70 system. (men) or age 65 (women), subject to a minimum deferral period of 7 weeks. Coverage Age addition: Aged 80 or older. Employed persons aged 16 to 65 (men) or aged 16 to 60 State second pension (S2P): Contributions paid as an (women) with weekly earnings of at least £77. employed person on earnings between the National Insurance Self-employed persons aged 16 to 65 (men) or aged 16 to 60 lower and upper earnings level in any tax year from April 1978. (women) with annual income of at least £4,095 are covered Beginning April 2003, under certain conditions, carers with for all benefits except the state second pension, work injury earnings below set limits (or no earnings) and people who have benefits, and contributory jobseeker’s allowance. a long-term illness or disability will be credited at a specified Voluntary contributors are covered for the basic State threshold for each year they are caring or receiving an eligible Retirement Pension and survivor’s benefits only. benefit. Beginning October 2003, the pension credit (means-tested) is Old-person’s pension (noncontributory retirement available to all residents aged 60 or older. pension): Aged 80 or older and ineligible for the contributory pension or entitled to a pension of less than £46.35 a week. Must have been resident in the UK for Source of Funds 10 years in any 20-year consecutive period after age 60. Insured person: 11% of weekly earnings between £89.01 and Pension credit: Men and women aged 60 or older (rising £595; certain married women and widows contribute 4.85%, gradually to age 65 from 2010 to 2020), resident in the UK, plus an additional 1% on earnings over £595. and whose income is below prescribed levels. Self-employed person: A flat-rate contribution of £2 a week if Long-term incapacity benefit: Contributions are paid on earnings are more than £4,095. In addition, self-employed earnings of at least 25 times the weekly lower earnings level persons with annual profits between £4,615 and £30,940 pay in one of the last 3 tax years before the benefit claim year, plus an earnings-related contribution of 8%, plus 1% of any contributions paid or credited on earnings of at least 50 times profits above £30,490. the weekly lower earnings level in both of the last 2 tax years Voluntary contributor: A flat-rate contribution of £6.95 a before the claim starts. The benefit is payable after 52 weeks of week. disability (as determined by a medical test); after 28 weeks to those who are terminally ill or receiving the highest-rate Employer: 12.8% of employee’s earnings over £89 a week. component of disability living allowance. Government: Total cost of means-tested allowances and Disability living allowance (noncontributory, no means other noncontributory benefits. Also, a treasury grant to test): Disabled before age 65 (can be paid beyond age 65). contributory programs up to a maximum of 17% of benefit The allowance is usually paid after 3 months of disability expenditure per year to cover shortfalls. (except if terminally ill). The amount is determined by care and 15% of all the above contributions is allocated to the National mobility needs. Health Service toward the cost of medical benefits. Attendance allowance (noncontributory, no means test): Disabled at age 65 or older. The allowance is usually paid Qualifying Conditions after 6 months of disability (except if terminally ill). The Basic state retirement pension (flat rate): Age 65 (men) or lower or higher allowance rate is determined by care needs. age 60 (women, rising gradually to age 65 from 2010 to

Global Benefits Assessment Sample Page 42 Page 44

Global Benefits Assessment Sample Page 42 Page 44