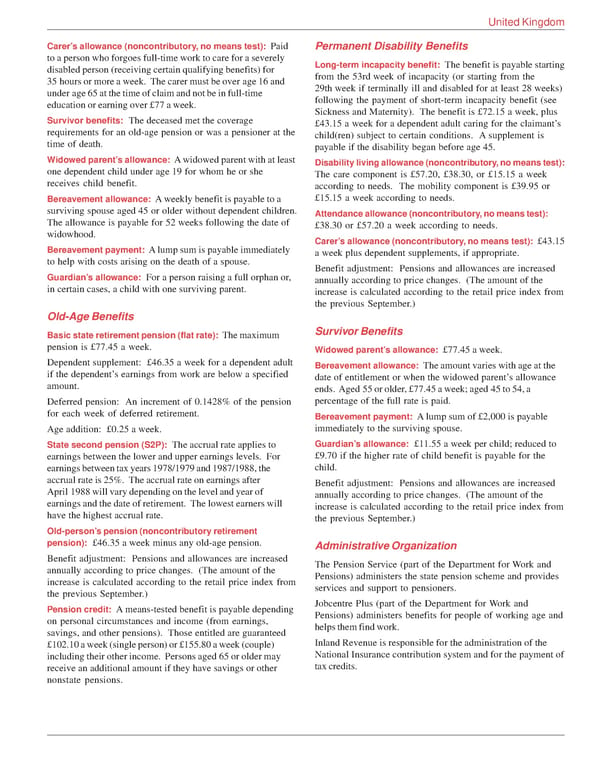

United Kingdom Carer’s allowance (noncontributory, no means test): Paid Permanent Disability Benefits to a person who forgoes full-time work to care for a severely Long-term incapacity benefit: The benefit is payable starting disabled person (receiving certain qualifying benefits) for from the 53rd week of incapacity (or starting from the 35 hours or more a week. The carer must be over age 16 and 29th week if terminally ill and disabled for at least 28 weeks) under age 65 at the time of claim and not be in full-time following the payment of short-term incapacity benefit (see education or earning over £77 a week. Sickness and Maternity). The benefit is £72.15 a week, plus Survivor benefits: The deceased met the coverage £43.15 a week for a dependent adult caring for the claimant’s requirements for an old-age pension or was a pensioner at the child(ren) subject to certain conditions. A supplement is time of death. payable if the disability began before age 45. Widowed parent’s allowance: A widowed parent with at least Disability living allowance (noncontributory, no means test): one dependent child under age 19 for whom he or she The care component is £57.20, £38.30, or £15.15 a week receives child benefit. according to needs. The mobility component is £39.95 or Bereavement allowance: A weekly benefit is payable to a £15.15 a week according to needs. surviving spouse aged 45 or older without dependent children. Attendance allowance (noncontributory, no means test): The allowance is payable for 52 weeks following the date of £38.30 or £57.20 a week according to needs. widowhood. Carer’s allowance (noncontributory, no means test): £43.15 Bereavement payment: A lump sum is payable immediately a week plus dependent supplements, if appropriate. to help with costs arising on the death of a spouse. Benefit adjustment: Pensions and allowances are increased Guardian’s allowance: For a person raising a full orphan or, annually according to price changes. (The amount of the in certain cases, a child with one surviving parent. increase is calculated according to the retail price index from the previous September.) Old-Age Benefits Basic state retirement pension (flat rate): The maximum Survivor Benefits pension is £77.45 a week. Widowed parent’s allowance: £77.45 a week. Dependent supplement: £46.35 a week for a dependent adult Bereavement allowance: The amount varies with age at the if the dependent’s earnings from work are below a specified date of entitlement or when the widowed parent’s allowance amount. ends. Aged 55 or older, £77.45 a week; aged 45 to 54, a Deferred pension: An increment of 0.1428% of the pension percentage of the full rate is paid. for each week of deferred retirement. Bereavement payment: A lump sum of £2,000 is payable Age addition: £0.25 a week. immediately to the surviving spouse. State second pension (S2P): The accrual rate applies to Guardian’s allowance: £11.55 a week per child; reduced to earnings between the lower and upper earnings levels. For £9.70 if the higher rate of child benefit is payable for the earnings between tax years 1978/1979 and 1987/1988, the child. accrual rate is 25%. The accrual rate on earnings after Benefit adjustment: Pensions and allowances are increased April 1988 will vary depending on the level and year of annually according to price changes. (The amount of the earnings and the date of retirement. The lowest earners will increase is calculated according to the retail price index from have the highest accrual rate. the previous September.) Old-person’s pension (noncontributory retirement pension): £46.35 a week minus any old-age pension. Administrative Organization Benefit adjustment: Pensions and allowances are increased The Pension Service (part of the Department for Work and annually according to price changes. (The amount of the Pensions) administers the state pension scheme and provides increase is calculated according to the retail price index from services and support to pensioners. the previous September.) Jobcentre Plus (part of the Department for Work and Pension credit: A means-tested benefit is payable depending Pensions) administers benefits for people of working age and on personal circumstances and income (from earnings, helps them find work. savings, and other pensions). Those entitled are guaranteed £102.10 a week (single person) or £155.80 a week (couple) Inland Revenue is responsible for the administration of the including their other income. Persons aged 65 or older may National Insurance contribution system and for the payment of receive an additional amount if they have savings or other tax credits. nonstate pensions.

Global Benefits Assessment Sample Page 43 Page 45

Global Benefits Assessment Sample Page 43 Page 45