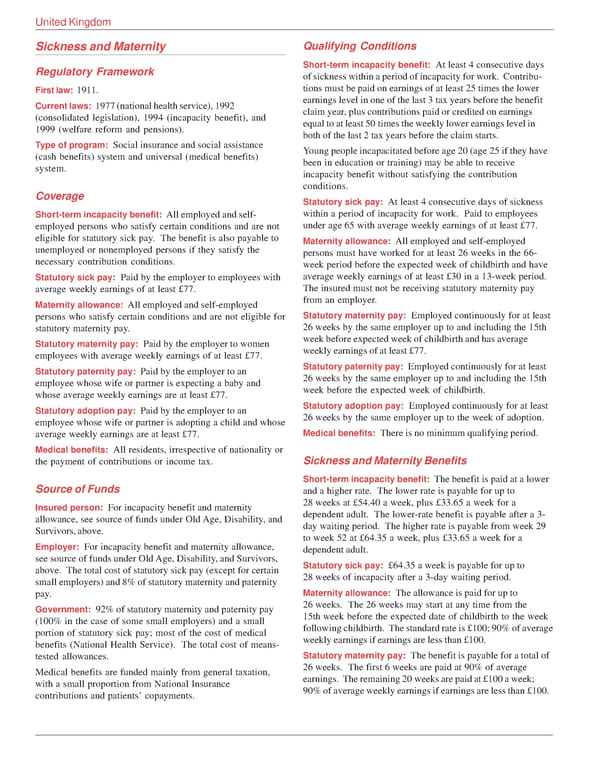

United Kingdom Sickness and Maternity Qualifying Conditions Regulatory Framework Short-term incapacity benefit: At least 4 consecutive days of sickness within a period of incapacity for work. Contribu- First law: 1911. tions must be paid on earnings of at least 25 times the lower Current laws: 1977 (national health service), 1992 earnings level in one of the last 3 tax years before the benefit (consolidated legislation), 1994 (incapacity benefit), and claim year, plus contributions paid or credited on earnings 1999 (welfare reform and pensions). equal to at least 50 times the weekly lower earnings level in Type of program: Social insurance and social assistance both of the last 2 tax years before the claim starts. (cash benefits) system and universal (medical benefits) Young people incapacitated before age 20 (age 25 if they have system. been in education or training) may be able to receive incapacity benefit without satisfying the contribution Coverage conditions. Statutory sick pay: At least 4 consecutive days of sickness Short-term incapacity benefit: All employed and self- within a period of incapacity for work. Paid to employees employed persons who satisfy certain conditions and are not under age 65 with average weekly earnings of at least £77. eligible for statutory sick pay. The benefit is also payable to Maternity allowance: All employed and self-employed unemployed or nonemployed persons if they satisfy the persons must have worked for at least 26 weeks in the 66- necessary contribution conditions. week period before the expected week of childbirth and have Statutory sick pay: Paid by the employer to employees with average weekly earnings of at least £30 in a 13-week period. average weekly earnings of at least £77. The insured must not be receiving statutory maternity pay Maternity allowance: All employed and self-employed from an employer. persons who satisfy certain conditions and are not eligible for Statutory maternity pay: Employed continuously for at least statutory maternity pay. 26 weeks by the same employer up to and including the 15th Statutory maternity pay: Paid by the employer to women week before expected week of childbirth and has average employees with average weekly earnings of at least £77. weekly earnings of at least £77. Statutory paternity pay: Paid by the employer to an Statutory paternity pay: Employed continuously for at least employee whose wife or partner is expecting a baby and 26 weeks by the same employer up to and including the 15th whose average weekly earnings are at least £77. week before the expected week of childbirth. Statutory adoption pay: Paid by the employer to an Statutory adoption pay: Employed continuously for at least employee whose wife or partner is adopting a child and whose 26 weeks by the same employer up to the week of adoption. average weekly earnings are at least £77. Medical benefits: There is no minimum qualifying period. Medical benefits: All residents, irrespective of nationality or the payment of contributions or income tax. Sickness and Maternity Benefits Source of Funds Short-term incapacity benefit: The benefit is paid at a lower and a higher rate. The lower rate is payable for up to Insured person: For incapacity benefit and maternity 28 weeks at £54.40 a week, plus £33.65 a week for a allowance, see source of funds under Old Age, Disability, and dependent adult. The lower-rate benefit is payable after a 3- Survivors, above. day waiting period. The higher rate is payable from week 29 Employer: For incapacity benefit and maternity allowance, to week 52 at £64.35 a week, plus £33.65 a week for a see source of funds under Old Age, Disability, and Survivors, dependent adult. above. The total cost of statutory sick pay (except for certain Statutory sick pay: £64.35 a week is payable for up to small employers) and 8% of statutory maternity and paternity 28 weeks of incapacity after a 3-day waiting period. pay. Maternity allowance: The allowance is paid for up to Government: 92% of statutory maternity and paternity pay 26 weeks. The 26 weeks may start at any time from the (100% in the case of some small employers) and a small 15th week before the expected date of childbirth to the week portion of statutory sick pay; most of the cost of medical following childbirth. The standard rate is £100; 90% of average benefits (National Health Service). The total cost of means- weekly earnings if earnings are less than £100. tested allowances. Statutory maternity pay: The benefit is payable for a total of Medical benefits are funded mainly from general taxation, 26 weeks. The first 6 weeks are paid at 90% of average with a small proportion from National Insurance earnings. The remaining 20 weeks are paid at £100 a week; contributions and patients’ copayments. 90% of average weekly earnings if earnings are less than £100.

Global Benefits Assessment Sample Page 44 Page 46

Global Benefits Assessment Sample Page 44 Page 46