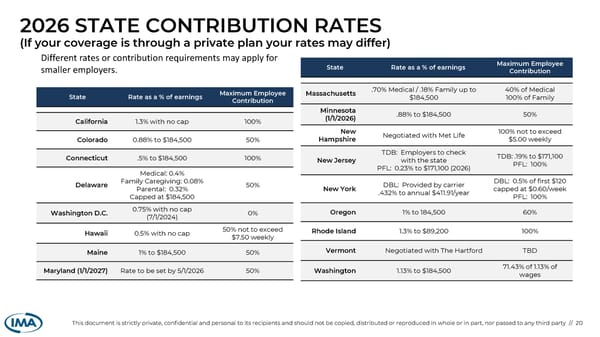

2026 STATE CONTRIBUTION RATES (If your coverage is through a private plan your rates may differ) State Rate as a % of earnings Maximum Employee Contribution Massachusetts .70% Medical / .18% Family up to $184,500 40% of Medical 100% of Family Minnesota (1/1/2026) .88% to $184,500 50% New Hampshire Negotiated with Met Life 100% not to exceed $5.00 weekly New Jersey TDB: Employers to check with the state PFL: 0.23% to $171,100 (2026) TDB: .19% to $171,100 PFL: 100% New York DBL: Provided by carrier .432% to annual $411.91/year DBL: 0.5% of first $120 capped at $0.60/week PFL: 100% Oregon 1% to 184,500 60% Rhode Island 1.3% to $89,200 100% Vermont Negotiated with The Hartford TBD Washington 1.13% to $184,500 71.43% of 1.13% of wages State Rate as a % of earnings Maximum Employee Contribution California 1.3% with no cap 100% Colorado 0.88% to $184,500 50% Connecticut .5% to $184,500 100% Delaware Medical: 0.4% Family Caregiving: 0.08% Parental: 0.32% Capped at $184,500 50% Washington D.C. 0.75% with no cap (7/1/2024) 0% Hawaii 0.5% with no cap 50% not to exceed $7.50 weekly Maine 1% to $184,500 50% Maryland (1/1/2027) Rate to be set by 5/1/2026 50% This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party // 20 Different rates or contribution requirements may apply for smaller employers.

Overview of State Paid Leave Laws Page 19 Page 21

Overview of State Paid Leave Laws Page 19 Page 21