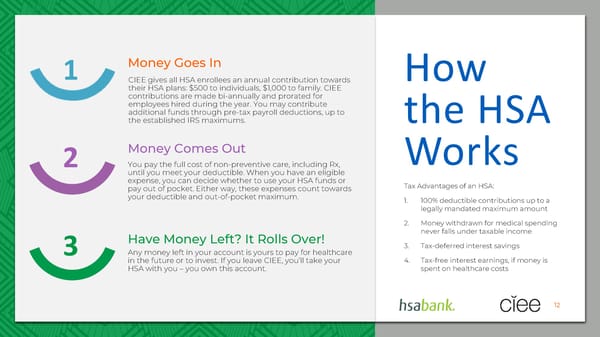

1 Money Goes In How CIEE gives all HSA enrollees an annual contribution towards their HSA plans: $500 to individuals, $1,000 to family. CIEE contributions are made bi-annually and prorated for employees hired during the year. You may contribute additional funds through pre-tax payroll deductions, up to the established IRS maximums. the HSA Money Comes Out Works 2 You pay the full cost of non-preventive care, including Rx, until you meet your deductible. When you have an eligible expense, you can decide whether to use your HSA funds or Tax Advantages of an HSA: pay out of pocket. Either way, these expenses count towards your deductible and out-of-pocket maximum. 1. 100% deductible contributions up to a legally mandated maximum amount 2. Money withdrawn for medical spending Have Money Left? It Rolls Over! never falls under taxable income 3 Any money left in your account is yours to pay for healthcare 3. Tax-deferred interest savings in the future or to invest. If you leave CIEE, you’ll take your 4. Tax-free interest earnings, if money is HSA with you – you own this account. spent on healthcare costs 12

CIEE 2024 Employee Benefit Guide Page 11 Page 13

CIEE 2024 Employee Benefit Guide Page 11 Page 13