CIEE 2024 Employee Benefit Guide

Benefits run January 1, 2024 - December 31, 2024

EMPLOYEE BENEFITS GUIDE Benefits for January 1, 2024 – December 31, 2024

Time Off PTO, Holidays, Floating Fridays, Day of Service, Leave 2

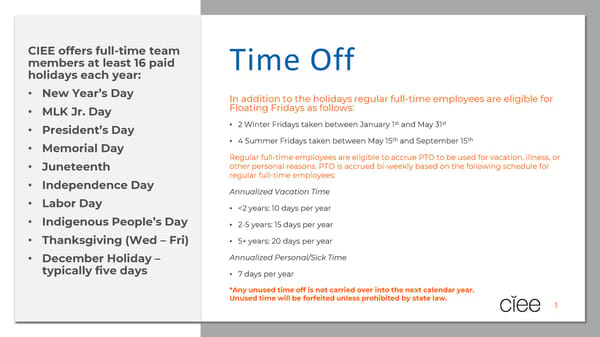

CIEE offers full-time team members at least 16 paid Time Off holidays each year: • New Year’s Day In addition to the holidays regular full-time employees are eligible for • MLK Jr. Day Floating Fridays as follows: st st • President’s Day • 2 Winter Fridays taken between January 1 and May 31 th th • Memorial Day • 4 Summer Fridays taken between May 15 and September 15 Regular full-time employees are eligible to accrue PTO to be used for vacation, illness, or • Juneteenth other personal reasons. PTO is accrued bi-weekly based on the following schedule for • Independence Day regular full-time employees: Annualized Vacation Time • Labor Day •

Leave of Absence CIEE provides various types of leaves which include: • Parental Care Leave • Family Medical Leave (FMLA) • Personal Leave • Military Leave • Bereavement Leave • Documentation and prior authorization are required • Length of leave is based on meeting eligibility requirements and applicable state laws • Contact HR Benefits for additional information: [email protected] 4

Core Benefits Medical, dental, vision, health savings account (HSA) 5

Eligibility As a CIEE employee, you are eligible for benefits if you work at least 30 hours per week. Benefits are effective on the first day of the month following your date of hire. You may enroll your eligible dependents for coverage once you are eligible. Your eligible dependents include: Your legal spouse Your domestic partner Your children up to the age of 26 (Children will be covered until the last day of the month in which they turn 26) Once your benefit elections become effective, they remain in effect until December 31. You may only If you have a qualifying life event, change your benefits within 30 days of a qualified life event. New hires and rehires have 30 days to enroll contact ADP MyLife Advisors to in benefits. If you have a qualifying life event, contact ADP MyLife Advisors to make the applicable change make the applicable change to to your benefits. your benefits. This guide is a brief summary of benefits offered to your group and does not constitute a policy. CIEE reserves to itself, pursuant to its sole and exclusive discretion, the right to change, amend or terminate the benefits program at any time. [email protected] The insurance companies’ plan descriptions will contain the actual detailed provisions of your benefits. If there are any discrepancies between the information in the guide and the insurance companies’ plan descriptions, the language in the 1-855-547-8508 insurance companies’ plan descriptions will always prevail. You can find detailed information on all of our programs by visiting the company HR website. 6

Medical Plan Options OPEN ACCESS PLUS PPO In-Network Out-of-Network Deductible $500 member / $1,500 family $1,000 member / $3,000 family Out-of-Pocket Max $2,250 member / $4,500 family $6,000 member / $11,000 family Routine Physical Covered at 100% Covered at 100% PCP Office Visit $5 copay (tiered) / $25 copay (non-tiered) Not covered (tiered) / 40% after deductible (non-tiered) Specialist Visit $20 copay (tiered) / $40 copay (non-tiered) Not covered (tiered) / 40% after deductible (non-tiered) Emergency Room Visit $150 copay $150 copay Diagnostic Lab/X-Ray 20% after deductible 40% after deductible Imaging 20% after deductible 40% after deductible Inpatient Care 20% after deductible 40% after deductible Outpatient Care 20% after deductible 40% after deductible Prescriptions (30-day retail / 90-day mail-order) Generic $10 / $20 Not covered Preferred brand $30 / $40 Not covered Non-Preferred Brand $50 / $150 Not covered Specialty $150 / $300 Not covered Rx Out-of-Pocket Max $3,000 member / $9,000 family N/A *Services from out-of-network providers may be subject to balance billing (member would be responsible for any difference between the allowance and the provider’s actual charge). 7

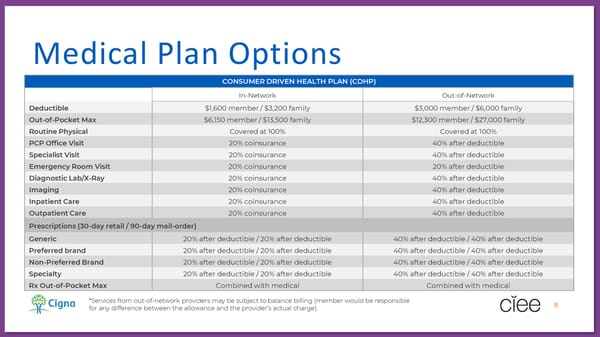

Medical Plan Options CONSUMER DRIVEN HEALTH PLAN (CDHP) In-Network Out-of-Network Deductible $1,600 member / $3,200 family $3,000 member / $6,000 family Out-of-Pocket Max $6,150 member / $13,500 family $12,300 member / $27,000 family Routine Physical Covered at 100% Covered at 100% PCP Office Visit 20% coinsurance 40% after deductible Specialist Visit 20% coinsurance 40% after deductible Emergency Room Visit 20% coinsurance 20% after deductible Diagnostic Lab/X-Ray 20% coinsurance 40% after deductible Imaging 20% coinsurance 40% after deductible Inpatient Care 20% coinsurance 40% after deductible Outpatient Care 20% coinsurance 40% after deductible Prescriptions (30-day retail / 90-day mail-order) Generic 20% after deductible / 20% after deductible 40% after deductible / 40% after deductible Preferred brand 20% after deductible / 20% after deductible 40% after deductible / 40% after deductible Non-Preferred Brand 20% after deductible / 20% after deductible 40% after deductible / 40% after deductible Specialty 20% after deductible / 20% after deductible 40% after deductible / 40% after deductible Rx Out-of-Pocket Max Combined with medical Combined with medical *Services from out-of-network providers may be subject to balance billing (member would be responsible 8 for any difference between the allowance and the provider’s actual charge).

Get the most out of your medical plan by using all of the free resources Cigna offers Cigna to members scan to One-Guide Customer Service Extras download Get one-on –one support you need to take control of your health – and your health spending. You can call one guide customer service for health coaching, specialized support, or cost saving guidance. Telehealth Cigna Member App See a doctor 24/7 with virtual care services. Employees will usually get an appointment in an track claims & benefits hour or less, anytime, day or night. Secure (safe) Travel check deductible Provides pre-trip planning, assistance while balances traveling, and unlimited medical evacuation and repatriation benefits when traveling 100 miles or find a doctor more from home. Cigna Healthy Rewards track your medications Use your Cigna ID Wallet when you pay and let the savings begin! Save on items like: Nutritional Meal view your member ID Delivery Services, Vision Care, Lasik Surgery, Alternative Medicine and More! card myCigna Mobile App Track claims and benefits, check deductible contact member balances, find a doctor, view your prescriptions, and services complete reimbursement forms for Fitness and member login support learn more Weight Loss. visit the Cigna website My Secure Advantage 30 Days pre-paid money-coaching for all types of to learn more financial planning and challenges; includes identity theft and fraud resolution services, and online tools for state specific wills and other important legal documents. 9

Medical Plan Education Know Where to Go Learn how you can save money for the same care by choosing the right facility Click here to learn where to go Staying In Network You will almost always save money by getting your care in-network Click here to learn more Learn the Lingo Insurance terminology can be confusing, so you may want to brush up on definitions Click here to browse some common healthcare definitions 10

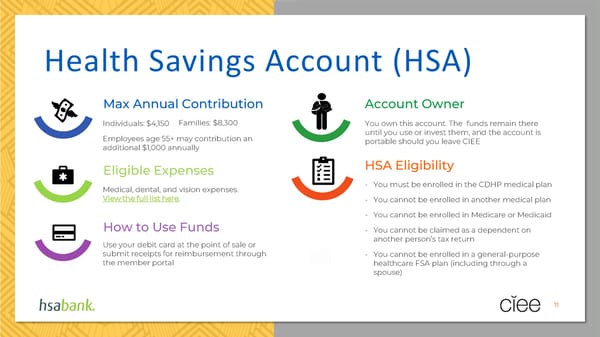

Health Savings Account (HSA) Max Annual Contribution Account Owner Individuals: $4,150 Families: $8,300 You own this account. The funds remain there Employees age 55+ may contribution an until you use or invest them, and the account is additional $1,000 annually portable should you leave CIEE Eligible Expenses HSA Eligibility Medical, dental, and vision expenses. - You must be enrolled in the CDHP medical plan View the full list here. - You cannot be enrolled in another medical plan - You cannot be enrolled in Medicare or Medicaid How to Use Funds - You cannot be claimed as a dependent on Use your debit card at the point of sale or another person’s tax return submit receipts for reimbursement through - You cannot be enrolled in a general-purpose the member portal healthcare FSA plan (including through a spouse) 11

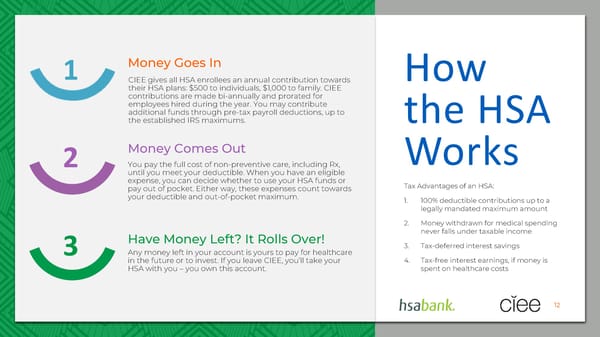

1 Money Goes In How CIEE gives all HSA enrollees an annual contribution towards their HSA plans: $500 to individuals, $1,000 to family. CIEE contributions are made bi-annually and prorated for employees hired during the year. You may contribute additional funds through pre-tax payroll deductions, up to the established IRS maximums. the HSA Money Comes Out Works 2 You pay the full cost of non-preventive care, including Rx, until you meet your deductible. When you have an eligible expense, you can decide whether to use your HSA funds or Tax Advantages of an HSA: pay out of pocket. Either way, these expenses count towards your deductible and out-of-pocket maximum. 1. 100% deductible contributions up to a legally mandated maximum amount 2. Money withdrawn for medical spending Have Money Left? It Rolls Over! never falls under taxable income 3 Any money left in your account is yours to pay for healthcare 3. Tax-deferred interest savings in the future or to invest. If you leave CIEE, you’ll take your 4. Tax-free interest earnings, if money is HSA with you – you own this account. spent on healthcare costs 12

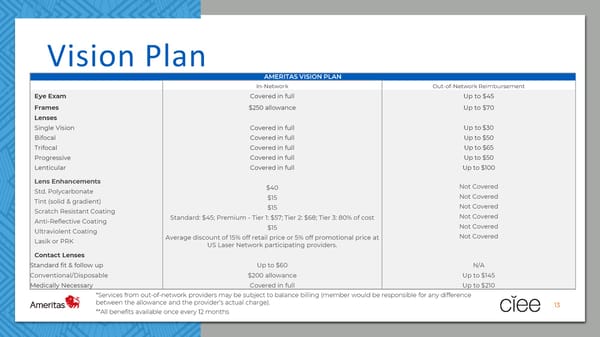

Vision Plan AMERITAS VISION PLAN In-Network Out-of-Network Reimbursement Eye Exam Covered in full Up to $45 Frames $250 allowance Up to $70 Lenses Single Vision Covered in full Up to $30 Bifocal Covered in full Up to $50 Trifocal Covered in full Up to $65 Progressive Covered in full Up to $50 Lenticular Covered in full Up to $100 Lens Enhancements Not Covered Std. Polycarbonate $40 Tint (solid & gradient) $15 Not Covered Scratch Resistant Coating $15 Not Covered Anti-Reflective Coating Standard: $45; Premium - Tier 1: $57; Tier 2: $68; Tier 3: 80% of cost Not Covered Ultraviolent Coating $15 Not Covered Lasik or PRK Average discount of 15% off retail price or 5% off promotional price at Not Covered US Laser Network participating providers. Contact Lenses Standard fit & follow up Up to $60 N/A Conventional/Disposable $200 allowance Up to $145 Medically Necessary Covered in full Up to $210 *Services from out-of-network providers may be subject to balance billing (member would be responsible for any difference between the allowance and the provider’s actual charge). 13 **All benefits available once every 12 months

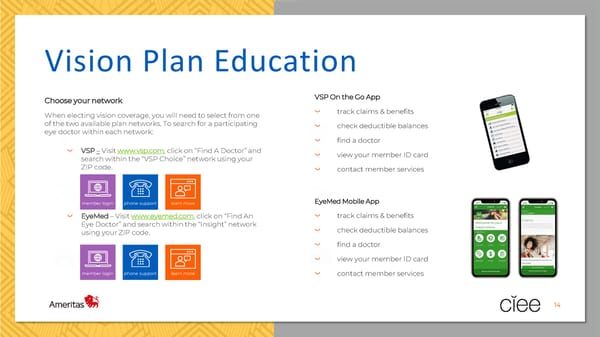

Vision Plan Education Choose your network VSP On the Go App When electing vision coverage, you will need to select from one track claims & benefits of the two available plan networks. To search for a participating check deductible balances eye doctor within each network: find a doctor VSP – Visit www.vsp.com, click on “Find A Doctor” and view your member ID card search within the “VSP Choice” network using your ZIP code. contact member services member login phone support learn more EyeMed Mobile App EyeMed – Visit www.eyemed.com, click on “Find An track claims & benefits Eye Doctor” and search within the “Insight” network check deductible balances using your ZIP code. find a doctor view your member ID card member login phone support learn more contact member services 14

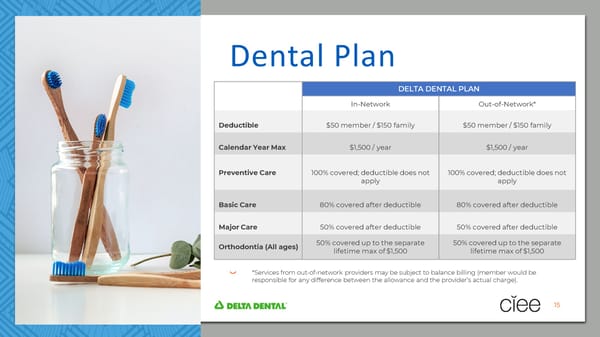

Dental Plan DELTA DENTAL PLAN In-Network Out-of-Network* Deductible $50 member / $150 family $50 member / $150 family Calendar Year Max $1,500 / year $1,500 / year Preventive Care 100% covered; deductible does not 100% covered; deductible does not apply apply Basic Care 80% covered after deductible 80% covered after deductible Major Care 50% covered after deductible 50% covered after deductible Orthodontia (All ages) 50% covered up to the separate 50% covered up to the separate lifetime max of $1,500 lifetime max of $1,500 *Services from out-of-network providers may be subject to balance billing (member would be responsible for any difference between the allowance and the provider’s actual charge). 15

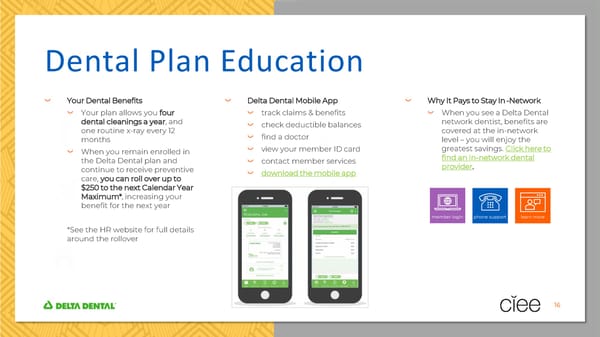

Dental Plan Education Your Dental Benefits Delta Dental Mobile App Why It Pays to Stay In-Network Your plan allows you four track claims & benefits When you see a Delta Dental dental cleanings a year, and check deductible balances network dentist, benefits are one routine x-ray every 12 find a doctor covered at the in-network months level – you will enjoy the When you remain enrolled in view your member ID card greatest savings. Click here to the Delta Dental plan and contact member services find an in-network dental continue to receive preventive download the mobile app provider. care, you can roll over up to $250 to the next Calendar Year Maximum*, increasing your benefit for the next year member login phone support learn more *See the HR website for full details around the rollover 16

Voluntary Benefits Life insurance, flexible spending accounts (FSA), accident insurance, critical illness insurance, 403(b) retirement plan 17

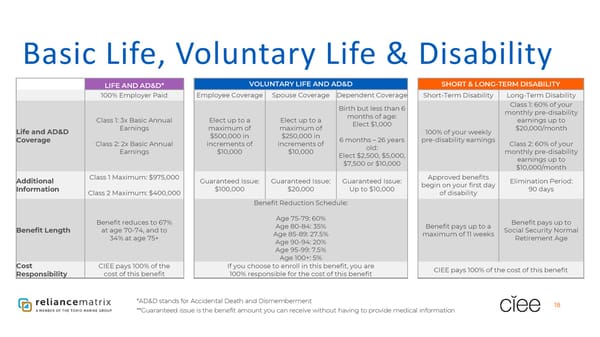

Basic Life, Voluntary Life & Disability LIFE AND AD&D* VOLUNTARY LIFE AND AD&D SHORT & LONG-TERM DISABILITY 100% Employer Paid Employee Coverage Spouse Coverage Dependent Coverage Short-Term Disability Long-Term Disability Birth but less than 6 Class 1: 60% of your months of age: monthly pre-disability Class 1: 3x Basic Annual Elect up to a Elect up to a Elect $1,000 earnings up to Life and AD&D Earnings maximum of maximum of 100% of your weekly $20,000/month Coverage $500,000 in $250,000 in 6 months – 26 years pre-disability earnings Class 2: 2x Basic Annual increments of increments of old: Class 2: 60% of your Earnings $10,000 $10,000 Elect $2,500, $5,000, monthly pre-disability $7,500 or $10,000 earnings up to $10,000/month Additional Class 1 Maximum: $975,000 Guaranteed Issue: Guaranteed Issue: Guaranteed Issue: Approved benefits Elimination Period: Information $100,000 $20,000 Up to $10,000 begin on your first day 90 days Class 2 Maximum: $400,000 of disability Benefit Reduction Schedule: Benefit reduces to 67% Age 75-79: 60% Benefit pays up to Benefit Length at age 70-74, and to Age 80-84: 35% Benefit pays up to a Social Security Normal 34% at age 75+ Age 85-89: 27.5% maximum of 11 weeks Retirement Age Age 90-94: 20% Age 95-99: 7.5% Age 100+: 5% Cost CIEE pays 100% of the If you choose to enroll in this benefit, you are CIEE pays 100% of the cost of this benefit Responsibility cost of this benefit 100% responsible for the cost of this benefit *AD&D stands for Accidental Death and Dismemberment 18 **Guaranteed issue is the benefit amount you can receive without having to provide medical information

Healthcare Flexible Spending Account (FSA) How It Works Enrolling in the Healthcare FSA Contribute up to $3,200 pre-tax - Per IRS regulations, participants are required to designate a new contribution annually amount each year Use funds to pay for eligible - When you enroll, you will elect the amount you would like to contribute for the medical, dental, and vision entire plan year expenses. You can view eligible expenses here - On the first day of the plan, your entire annual election is available to use Use your debit card at the point of Watch: Everything You Need to Know About FSAs sale or submit receipts for reimbursement through the member portal You may rollover up to $640 in unused funds from the 2024 plan year into 2025; funds remaining above the $640 rollover maximum will be forfeited 19

Dependent Care FSA How It Works Enrolling in the Dependent Care FSA Contribute up to $5,000 annually; - Per IRS regulations, participants are required to designate a new contribution or if married and filing separately, amount each year you may contribute up to $2,500 - When you enroll, you will elect the amount you would like to contribute for the each entire plan year Use funds to pay for eligible - Dependent Care FSA funds become available as they are distributed to your childcare and eldercare expenses. account from your paycheck You can view eligible expenses here Watch: Everything You Need to Know About FSAs You may submit receipts for reimbursement through the Wex, Inc. member portal or mobile app There is no rollover allowed; unused funds are forfeited 20

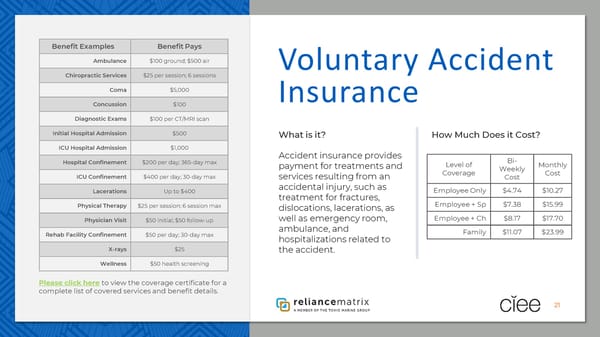

Benefit Examples Benefit Pays Ambulance $100 ground; $500 air Voluntary Accident Chiropractic Services $25 per session; 6 sessions Coma $5,000 Insurance Concussion $100 Diagnostic Exams $100 per CT/MRI scan Initial Hospital Admission $500 What is it? How Much Does it Cost? ICU Hospital Admission $1,000 Accident insurance provides Bi- Hospital Confinement $200 per day; 365-day max payment for treatments and Level of Monthly Coverage Weekly Cost ICU Confinement $400 per day; 30-day max services resulting from an Cost Lacerations Up to $400 accidental injury, such as Employee Only $4.74 $10.27 treatment for fractures, Employee + Sp $7.38 $15.99 Physical Therapy $25 per session; 6 session max dislocations, lacerations, as Physician Visit $50 initial; $50 follow-up well as emergency room, Employee + Ch $8.17 $17.70 Rehab Facility Confinement $50 per day; 30-day max ambulance, and Family $11.07 $23.99 hospitalizations related to X-rays $25 the accident. Wellness $50 health screening Please click here to view the coverage certificate for a complete list of covered services and benefit details. 21

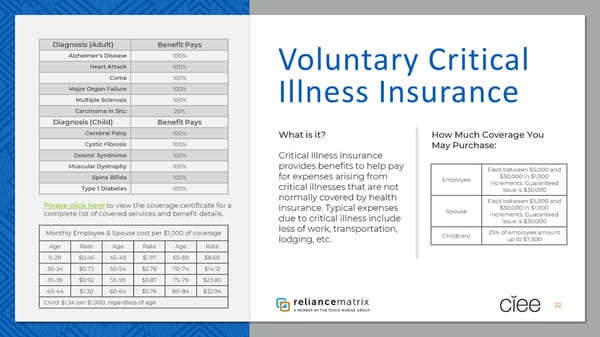

Diagnosis (Adult) Benefit Pays Alzheimer’s Disease 100% Heart Attack 100% Voluntary Critical Coma 100% Major Organ Failure 100% Multiple Sclerosis 100% Illness Insurance Carcinoma in Situ 25% Diagnosis (Child) Benefit Pays Cerebral Palsy 100% What is it? How Much Coverage You Cystic Fibrosis 100% May Purchase: Downs’ Syndrome 100% Critical Illness insurance Muscular Dystrophy 100% provides benefits to help pay Elect between $5,000 and Spina Bifida 100% for expenses arising from Employee $30,000 in $1,000 Type 1 Diabetes 100% critical illnesses that are not increments. Guaranteed normally covered by health issue is $30,000 Please click here to view the coverage certificate for a Elect between $5,000 and complete list of covered services and benefit details. insurance. Typical expenses Spouse $30,000 in $1,000 due to critical illness include increments. Guaranteed loss of work, transportation, issue is $30,000 Monthly Employee & Spouse cost per $1,000 of coverage Child(ren) 25% of employee amount lodging, etc. up to $7,500 Age Rate Age Rate Age Rate 0-29 $0.46 45-49 $1.97 65-69 $8.60 30-34 $0.73 50-54 $2.78 70-74 $14.12 35-39 $0.92 55-59 $3.87 75-79 $23.80 40-44 $1.30 60-64 $5.76 80-84 $32.94 Child: $1.34 per $1,000, regardless of age 22

Pet Insurance Caring for your pets can be expensive. CIEE employees are eligible for a 10% discount on pet insurance for one pet through ASPCA. If more than one pet is added to the policy, all additional pets will be covered with a 20% discounted cost to the employee. Monthly rates will vary depending on the breed and age of the pet being covered. Customizable options available: • Annual limit from $3-10k • Annual deductible from $100-$500 • Reimbursement percentages from 70-90% Employees can enroll or change their plan at any time by visiting: www.aspcapetinsurance.com/ciee Company Priority Code: EB22CIEE 23

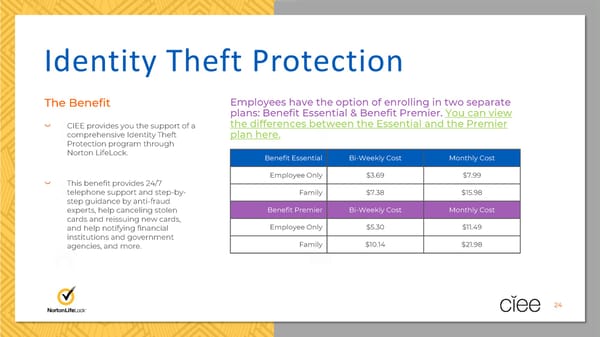

Identity Theft Protection The Benefit Employees have the option of enrolling in two separate You can view plans: Benefit Essential & Benefit Premier. CIEE provides you the support of a the differences between the Essential and the Premier comprehensive Identity Theft plan here. Protection program through Norton LifeLock. Benefit Essential Bi-Weekly Cost Monthly Cost Employee Only $3.69 $7.99 This benefit provides 24/7 telephone support and step-by- Family $7.38 $15.98 step guidance by anti-fraud experts, help canceling stolen Benefit Premier Bi-Weekly Cost Monthly Cost cards and reissuing new cards, and help notifying financial Employee Only $5.30 $11.49 institutions and government agencies, and more. Family $10.14 $21.98 24

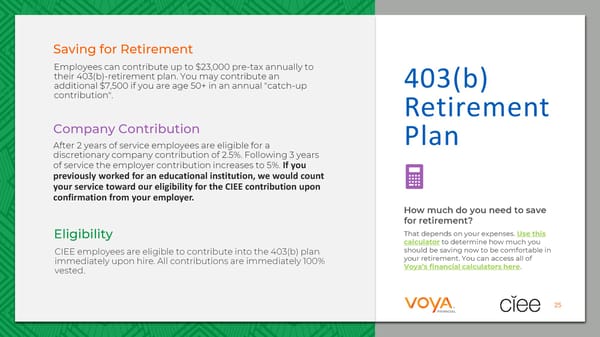

Saving for Retirement Employees can contribute up to $23,000 pre-tax annually to their 403(b)-retirement plan. You may contribute an 403(b) additional $7,500 if you are age 50+ in an annual "catch-up contribution". Retirement Company Contribution Plan After 2 years of service employees are eligible for a discretionary company contribution of 2.5%. Following 3 years of service the employer contribution increases to 5%. If you previously worked for an educational institution, we would count your service toward our eligibility for the CIEE contribution upon confirmation from your employer. How much do you need to save for retirement? Eligibility That depends on your expenses. Use this calculator to determine how much you CIEE employees are eligible to contribute into the 403(b) plan should be saving now to be comfortable in immediately upon hire. All contributions are immediately 100% your retirement. You can access all of . vested. Voya’s financial calculators here 25

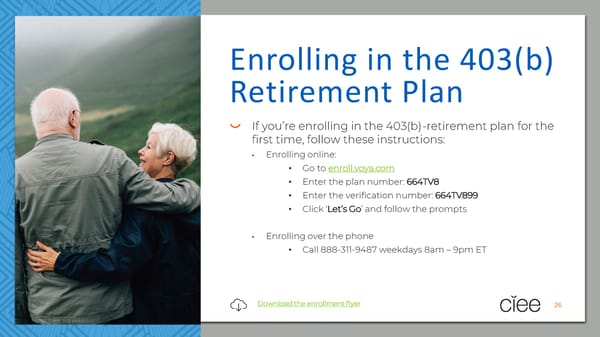

Enrolling in the 403(b) Retirement Plan If you’re enrolling in the 403(b)-retirement plan for the first time, follow these instructions: • Enrolling online: enroll.voya.com • Go to • Enter the plan number: 664TV8 • Enter the verification number: 664TV899 • Click ‘Let’s Go’ and follow the prompts • Enrolling over the phone • Call 888-311-9487 weekdays 8am – 9pm ET Download the enrollment flyer 26

Accessing your Retirement Account A Personal Identification Number (PIN) is required to access your account by phone or to register for online account access. After your account is set up, Voya will mail a unique PIN directly to you. Login to your member account online Access your account over the phone: 1-800-584-6001 Access your account from the mobile app Learn more about accessing your account by following the steps in this flyer. 27

Perks Employee assistance program (EAP), public service student loan forgiveness (PSLF), fitness reimbursement, education program discounts, ADP/LifeMart discount programs 28

Contact ACI Specialty Benefits Employee Assistance 24 hours a day Program 7 days a week ACI Specialty Benefits The EAP provides short-term CIEE offers a free and counseling, information, Call 1-800-932-0034 confidential Employee resources, and referrals Assistance Program (EAP) related to: through ACI Specialty that Depression, anxiety & other can assist you and your family mental health concerns Visit members to address any Stress management https://acispecialtybenefits. concern(s) that is a barrier to Childcare and elder care com/program/eap your health & well-being. All Legal and financial issues employees are automatically Nutrition consultation enrolled in this program at no And many other work-life issues cost to you. 29

What is the PSLF? Public This is a program that was signed into law in 2007 that allows for student loan forgiveness for those employed in public service or non-profit Service organizations upon meeting certain criteria. Student Eligiblity Any full-time CIEE employee is eligible to apply Loan and receive credit for service with us. Forgiveness How to Apply To apply for this benefit, access the PSLF Help (PSLF) Tool. Once you’ve completed your application, simply email it to us at [email protected], we’ll complete the employer portion and you’re on your way! CIEE employees are Learn How it Works eligible to participate in the federal government’s You can find complete information on the Public Service Loan program by accessing the Federal Student Aid Forgiveness (PSLF) site here. program. 30

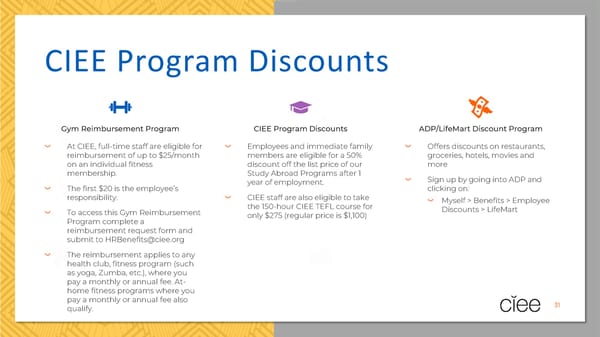

CIEE Program Discounts Gym Reimbursement Program CIEE Program Discounts ADP/LifeMart Discount Program At CIEE, full-time staff are eligible for Employees and immediate family Offers discounts on restaurants, reimbursement of up to $25/month members are eligible for a 50% groceries, hotels, movies and on an individual fitness discount off the list price of our more membership. Study Abroad Programs after 1 Sign up by going into ADP and The first $20 is the employee’s year of employment. clicking on: responsibility. CIEE staff are also eligible to take Myself > Benefits > Employee To access this Gym Reimbursement the 150-hour CIEE TEFL course for Discounts > LifeMart Program complete a only $275 (regular price is $1,100) reimbursement request form and submit to [email protected] The reimbursement applies to any health club, fitness program (such as yoga, Zumba, etc.), where you pay a monthly or annual fee. At- home fitness programs where you pay a monthly or annual fee also qualify. 31

Costs & Contacts 32

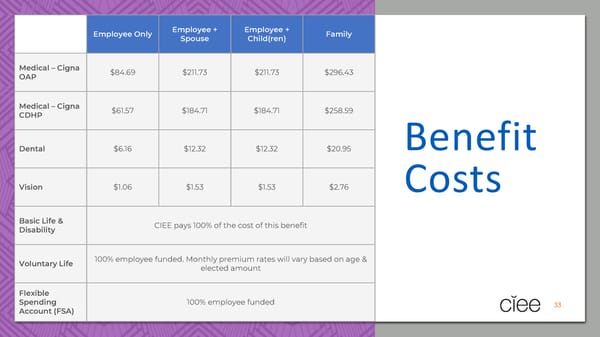

Employee Only Employee + Employee + Family Spouse Child(ren) Medical – Cigna $84.69 $211.73 $211.73 $296.43 OAP Medical – Cigna $61.57 $184.71 $184.71 $258.59 CDHP Benefit Dental $6.16 $12.32 $12.32 $20.95 Vision $1.06 $1.53 $1.53 $2.76 Costs Basic Life & CIEE pays 100% of the cost of this benefit Disability Voluntary Life 100% employee funded. Monthly premium rates will vary based on age & elected amount Flexible Spending 100% employee funded 33 Account (FSA)

Contacts Medical Vision Employee Assistance Cigna Ameritas (VSP or EyeMed Network) Program (EAP) 1-800-244-6224 1-800-659-2223 ACI Specialty Benefits Pharmacy Health & Dependent FSA 1-800-932-0034 CVS Caremark WEX Benefits Life, Voluntary Life, 1-800-552-8159 1-866-451-3399 Disability, Accident and Telehealth Health Savings Account Critical Illness MD Live HSA Bank Reliance Matrix 1-888-726-3171 1-800-244-6224 1-800-435-7775 Dental 403(b) Retirement MyLife Advisors Delta Dental Voya [email protected] 1-800-537-1715 1-800-584-6001 1-855-547-8508 34

Health Plan Notices 35

HEALTH PLAN NOTICES Nondiscrimination Act (GINA) - GINA prohibits the Plan Affordable Care Act Consumer Protections - (a.) Coverage for Children Up The Genetic Information to Age of 26. The Affordable Care Act of 2010 requires that the Plan must from discriminating against individuals on the basis of genetic information in make dependent coverage available to adult children until they turn 26 providing any benefits under the Plan. Genetic information includes the results of regardless if they are married, a dependent, or a student. genetic tests to determine whether someone is at increased risk of acquiring a (b.) Prohibition of Lifetime Dollar Value of Benefits: the Affordable Care Act condition in the future, as well as an individual’s family medical history. of 2010 prohibits the Plan from imposing a lifetime limit on the dollar Wellness - Your health plan is committed to helping you achieve your best health. If value of benefits. your Plan includes a Wellness program that provides rewards or surcharges based (c.) Your Health Insurance Cannot be Rescinded - The Affordable Care Act on your ability to complete an activity or satisfy an initial health standard, and if you of 2010 prohibits the Plan, or any insurer, from rescinding your health think you might be unable to meet a standard for a reward under the wellness insurance coverage except as permitted under the Act. program, you might qualify for an opportunity to earn the same reward by different means. Contact the Plan Administrator and we will work with you (and, if you wish, (d.) Prohibition of Pre-Existing Conditions - No insurance plan can reject with your doctor) to find a wellness program with the same reward that is right for you, charge you more, or refuse to pay for essential health benefits for any you in light of your health status. condition you had before your coverage started. Your Rights and Protections Against Surprise Medical Bills (e.) Prohibition of Restrictions on Annual Limits on Essential Benefits - The When you get emergency care or get treated by an out-of-network provider Affordable Care Act of 2010 prohibits the Plan, or any insurer, effective at an in-network hospital or ambulatory surgical center, you are protected January 1, 2014 from placing annual limits on the value of essential health from surprise billing or balance billing. benefits. What is “balance billing” (sometimes called “surprise billing”)? (f) Notice of Marketplace/Exchange - You have the option to purchase health insurance at the Health Insurance Marketplace. The Marketplace offers When you see a doctor or other health care provider, you may owe certain out-of- "one-stop shopping" to find and compare private health insurance options pocket costs, such as a copayment, coinsurance, and/or a deductible. You may as well as a premium tax credit or a cost sharing reduction for certain have other costs or have to pay the entire bill if you see a provider or visit a health qualified individuals. If you purchase a health plan through the Marketplace, care facility that isn’t in your health plan’s network. you will lose any employer contribution toward the cost of your health “Out-of-network” describes providers and facilities that haven’t signed a contract coverage. Employer contributions to employer-provided coverage may be with your health plan. Out-of-network providers may be permitted to bill you for the excludable for federal income tax purposes. The Marketplace can help you difference between what your plan agreed to pay and the full amount charged for a evaluate your coverage options, including your eligibility for coverage service. This is called “balance billing.” This amount is likely more than in-network for through the Marketplace and its cost. Please visit www.Healthcare.gov costs for the same service and might not count toward your annual out-of-pocket more information and contact information for a Health Insurance limit. Marketplace in your area. “Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

HEALTH PLAN NOTICES Special Enrollment Rights - If you are declining enrollment for yourself or your same deductibles and co-insurance applicable to other medical and surgical dependents (including your spouse) because of other health insurance or benefits provided under the ABC Company Health Plan. If you would like more group health plan coverage, you may be able to enroll yourself and your information on WHCRA benefits, please call your Plan Administrator dependents in this plan if you or your dependents lose eligibility for that other Regarding Lifetime and Annual Dollar Limits - In accordance with coverage(or if the employer stops contributing toward your or your Notice dependents’ other coverage). However, you must request enrollment within 30 applicable law, any lifetime dollar limits and annual dollar limits set forth in the days after your or your dependents’ other coverage ends (or after the employer Plan shall not apply to “essential health benefits,” as such term is defined under stops contributing toward the other coverage). In addition, if you have a new Section 1302(b) of the Affordable Care Act. The law defines “essential health dependent as a result of marriage, birth, adoption, or placement for adoption, benefits” to include, at minimum, items and services covered within certain you may be able to enroll yourself and your dependents. However, you must categories including emergency services, hospitalization, prescription drugs, request enrollment within 30 days after the marriage, birth, adoption, or rehabilitative and habilitative services and devices, and laboratory services. A placement for adoption. To request special enrollment or obtain more determination as to whether a benefit constitutes an “essential health benefit” information, contact the Plan Administrator. will be based on a good faith interpretation by the Plan Administrator of the Grandfathered Status - The Plan believes that none of the group health plans guidance available as of the date on which the determination is made. available under the Plan are “grandfathered health plans” as described under Patient Protection Disclosure - You have the right to designate any the Patient Protection and Affordable Care Act (the “Affordable Care Act”). participating primary care provider who is available to accept you or your Special Rule family members (for children, you may designate a pediatrician as the primary for Maternity and Infant Coverage - Group health plans and care provider). For information on how to select a primary care provider and for health insurance issuers generally may not, under Federal law, restrict a list of participating primary care providers, contact the Plan Administrator. benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, You do not need prior authorization from the Plan or from any other person, or less than 96 hours following a cesarean section. However, Federal law including your primary care provider, in order to obtain access to obstetrical or generally does not prohibit the attending provider or physician, after gynecological care from a health care professional; however, you may be consulting with the mother, from discharging the mother or her newborn required to comply with certain procedures, including obtaining prior earlier than 48 hours (or 96 hours, as applicable). authorization for certain services, following a pre-approved treatment plan, or Special Rule procedures for making referrals. For a list of participating health care for Women’s Health Coverage (WHCRA) - If you have had or are professionals who specialize in obstetrics or gynecology, contact the health going to have a mastectomy, you may be entitled to certain benefits under the plan. Women's Health and Cancer Rights Act of 1998 (WHCRA). For individuals receiving mastectomy-related benefits, coverage will be provided in a manner - Michelle’s Law provides continued health and dental determined in consultation with the attending physician and the patient, for: Michelle’s Law all stages of reconstruction of the breast on which the mastectomy was insurance benefits under the Plan for dependent children who are covered performed; surgery and reconstruction of the other breast to produce a under the Plan as a student but lose their student status in a post-secondary symmetrical appearance; prostheses; and treatment of physical complications school or college because they take a medically necessary leave of absence of the mastectomy, including lymphedema. These benefits will be provided from school. If your child is no longer a student because he or she is out of subject to the school because of a medically necessary leave of absence, your child may continue to be covered under the Plan for up to one year from the beginning of the leave of absence.

HEALTH PLAN NOTICES You are protected from balance billing for: health plan generally must: Your Emergency services - If you have an emergency medical condition and get Cover emergency services without requiring you to get approval for services emergency services from an out-of-network provider or facility, the most the in advance (prior authorization). provider or facility may bill you is your plan’s in-network cost-sharing amount Cover emergency services by out-of-network providers. (such as copayments and coinsurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable Base what you owe the provider or facility (cost-sharing) on what it would condition, unless you give written consent and give up your protections not pay an in-network provider or facility and show that amount in your to be balanced billed for these post-stabilization services. explanation of benefits. Certain services at an in-network hospital or ambulatory surgical center - Count any amount you pay for emergency services or out-of-network When you get services from an in-network hospital or ambulatory surgical services toward your deductible and out-of-pocket limit. center, certain providers there may be out-of-network. In these cases, the If you believe you’ve been wrongly billed, you may contact the Centers for most those providers may bill you is your plan’s in-network cost-sharing Medicare & Medicaid Services https://www.cms.gov/nosurprises amount. This applies to emergency medicine, anesthesia, pathology, Visit https://www.cms.gov/nosurprises/Policies-and-Resources/Overview-of- radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist rules-fact-sheets for more information about your rights under federal law. services. These providers can’t balance bill you and may not ask you to give up your protections not to be balance billed. If you get other services at these in-network facilities, out-of-network providers can’t balance bill you, unless you give written consent and give up your protections. You’re never required to give up your protections from balance billing. You also aren’t required to get care out-of-network. You can choose a provider or facility in your plan’s network. When balance billing isn’t allowed, you also have the following protections: You are only responsible for paying your share of the cost (like the copayments, coinsurance, and deductibles that you would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities directly.

HEALTH PLAN NOTICES 11. Important Notice About Your Prescription Drug Coverage and When Can You Join A Medicare Drug Plan? Medicare You can join a Medicare drug plan when you first become eligible for Please read this notice carefully and keep it where you can find it. This Medicare and each year from October 15th to December 7th. However, if notice has information about your current prescription drug coverage you lose your current creditable prescription drug coverage, through no with your employer and about your options under Medicare’s fault of your own, you will also be eligible for a two (2) month Special prescription drug coverage. This information can help you decide Enrollment Period (SEP) to join a Medicare drug plan. whether or not you want to join a Medicare drug plan. If you are What Happens To Your Current Coverage If You Decide to Join A considering joining, you should compare your current coverage, Medicare Drug Plan? including which drugs are covered at what cost, with the coverage and Your current coverage pays for other health expenses, in addition to costs of the plans offering Medicare prescription drug coverage in your prescription drugs. If you are actively employed and decide to join a area. Information about where you can get help to make decisions Medicare drug plan, your current medical coverage will not be affected; about your prescription drug coverage is at the end of this notice. There you can keep this coverage if you elect part D and this plan will are two important things you need to know about your current coordinate with Part D coverage. coverage and Medicare’s prescription drug coverage: 1. Medicare prescription drug coverage became available in 2006 to If you are actively employed and you decide to join a Medicare drug plan everyone with Medicare. You can get this coverage if you join a and drop your current medical coverage, be aware that you and your Medicare Prescription Drug Plan or join a Medicare Advantage Plan dependents may be able to get this coverage back at the next open (like an HMO or PPO) that offers prescription drug coverage. All enrollment period or upon a qualifying status change if you remain Medicare drug plans provide at least a standard level of coverage set by otherwise eligible to enroll in the Plan. Medicare. Some plans may also offer more coverage for a higher If you are no longer actively employed and you decide to join a Medicare monthly premium. drug plan and drop your current coverage, be aware that you and your 2. Your employer has determined that the prescription drug coverage dependents will not be able to get this coverage back. offered by the employer sponsored medical plans are, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and are therefore considered Creditable Coverage. Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan.

HEALTH PLAN NOTICES When Will You Pay A Higher Premium (Penalty) To Join A Medicare For More Information About Your Options Under Medicare Drug Plan? Prescription Drug Coverage… You should also know that if you drop or lose your current coverage and More detailed information about Medicare plans that offer prescription don’t join a Medicare drug plan within 63 continuous days after your drug coverage is in the “Medicare & You” handbook. You’ll get a copy of current coverage ends, you may pay a higher premium (a penalty) to the handbook in the mail every year from Medicare. You may also be join a Medicare drug plan later. contacted directly by Medicare drug plans. If you go 63 continuous days or longer without creditable prescription For more information about Medicare prescription drug coverage: drug coverage, your monthly premium may go up by at least 1% of the • Visit www.medicare.gov Medicare base beneficiary premium per month for every month that • Call your State Health Insurance Assistance Program (see the inside you did not have that coverage. For example, if you go nineteen back cover of your copy of the “Medicare & You” handbook for their months without creditable coverage, your premium may consistently telephone number) for personalized help be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you • Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877- have Medicare prescription drug coverage. In addition, you may have to 486-2048. wait until the following October to join. If you have limited income and resources, extra help paying for Medicare For More Information About This Notice Or Your Current prescription drug coverage is available. For information about this extra Prescription Drug Coverage… help, visit Social Security on the web at www.socialsecurity.gov, or call Contact the plan administrator for further information. them at 1-800-772-1213 (TTY 1-800-325-0778).

HEALTH PLAN NOTICES Premium Assistance Under Medicaid and the Children’s Health Insurance (CHIP) Program If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov. If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available. If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.govto find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan. If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.govor call 1-866-444- EBSA (3272).

HEALTH PLAN NOTICES Alabama Colorado Minnesota https://mn.gov/dhs/people-we-serve/children- Website: http://myalhipp.com/ Health First Colorado Website: Phone: 1-855-692-5447 and-families/health-care/health-care- https://www.healthfirstcolorado.com/ Health First Colorado Member Contact Center: programs/programs-and-services/other- Alaska 1-800-221-3943/ State Relay 711 insurance.jsp The AK Health Insurance Premium Payment CHP+: Phone: 1-800-657-3739 Program https://www.colorado.gov/pacific/hcpf/child- Website: http://myakhipp.com/ health-plan-plus Missouri Phone: 1-866-251-4861 CHP+ Customer Service: 1-800-359-1991/ State Website: Email: [email protected] Relay 711 http://www.dss.mo.gov/mhd/participants/pages/ Medicaid Eligibility: Health Insurance Buy-In Program (HIBI): hipp.htm http://dhss.alaska.gov/dpa/Pages/medicaid/defa https://www.colorado.gov/pacific/hcpf/health- Phone: 573-751-2005 ult.aspx insurance-buyprogram HIBI Customer Service: 1-855-692-6442 Montana Arkansas Website: Website: http://myarhipp.com/ Florida http://dphhs.mt.gov/MontanaHealthcareProgra Phone: 1-855-MyARHIPP (855-692-7447) Website: ms/HIPP https://www.flmedicaidtplrecovery.com/flmedic Phone: 1-800-694-3084 California aidtplrecovery.com/hipp/index.html Website: Health Insurance Premium Payment Phone: 1-877-357-3268 Nebraska (HIPP) Program Website: http://www.ACCESSNebraska.ne.gov http://dhcs.ca.gov/hipp Georgia Phone: 1-855-632-7633 https://medicaid.georgia.gov/health- Phone: 916-445-8322 Website: Lincoln: 402-473-7000 Email: [email protected] insurance-premium-payment-program-hipp Omaha: 402-595-1178 Phone: 678-564-1162 ext 2131 Nevada Massachusetts Medicaid Website: http://dhcfp.nv.gov https://www.mass.gov/info- Website: Medicaid Phone: 1-800-992-0900 details/masshealthpremium-assistance-pa Phone: 1-800-862-4840

HEALTH PLAN NOTICES New Hampshire Oregon Vermont Website: https://www.dhhs.nh.gov/oii/hipp.htm Website: Phone: 603-271-5218 Website: http://www.greenmountaincare.org/ Phone: 1-800-250-8427 Toll free number for the HIPP program: 1-800-852- http://healthcare.oregon.gov/Pages/index.aspx 3345, ext 5218 http://www.oregonhealthcare.gov/index-es.html Phone: 1-800-699-9075 Virginia https://www.coverva.org/en/famis- New Jersey Website: Pennsylvania Medicaid Website: select http://www.state.nj.us/humanservices/dmahs/clien Website: https://www.coverva.org/en/hipp https://www.dhs.pa.gov/providers/Providers/Pages/Me Medicaid Phone: 1-800-432-5924 ts/medicaid/ dical/HIPP-Program.aspx CHIP Phone: 1-800-432-5924 Medicaid Phone: 609-631-2392 Phone: 1-800-692-7462 CHIP Website: Washington http://www.njfamilycare.org/index.html Rhode Island CHIP Phone: 1-800-701-0710 Website: https://www.hca.wa.gov/ Website: http://www.eohhs.ri.gov/ Phone: 1-800-562-3022 New York Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte Website: Share Line) West Virginia Website: http://mywvhipp.com/ https://www.health.ny.gov/health_care/medicaid/ South Carolina Toll-free phone: 1-855-MyWVHIPP (1-855-699- Phone: 1-800-541-2831 Website: https://www.scdhhs.gov 8447) North Carolina Phone: 1-888-549-0820 Wisconsin Website: https://medicaid.ncdhhs.gov/ South Dakota Website: Phone: 919-855-4100 https://www.dhs.wisconsin.gov/badgercareplus Website: http://dss.sd.gov North Dakota Phone: 1-888-828-0059 /p-10095.htm Website: Phone: 1-800-362-3002 http://www.nd.gov/dhs/services/medicalserv/medic Texas Wyoming aid/ Website: http://gethipptexas.com/ Phone: 1-844-854-4825 Phone: 1-800-440-0493 Website: https://health.wyo.gov/healthcarefin/medicaid/ Oklahoma Utah programs-and-eligibility/ Website: http://www.insureoklahoma.org Medicaid Website: https://medicaid.utah.gov/ Phone: 1-800-251-1269 Phone: 1-888-365-3742 CHIP Website: http://health.utah.gov/chip Phone: 1-877-543-7669

HEALTH PLAN NOTICES To see if any other states have added a premium assistance program, or for Paperwork Reduction Act Statement more information on special enrollment rights, contact either: According to the Paperwork Reduction Act of 1995 (Pub. L. 104-13) (PRA), no U.S. Department of Labor persons are required to respond to a collection of information unless such Employee Benefits Security Administration collection displays a valid Office of Management and Budget (OMB) control www.dol.gov/agencies/ebsa number. The Department notes that a Federal agency cannot conduct or 1-866-444-EBSA (3272) sponsor a collection of information unless it is approved by OMB under the PRA, and displays a currently valid OMB control number, and the public is U.S. Department of Health and Human Services not required to respond to a collection of information unless it displays a Centers for Medicare & Medicaid Services currently valid OMB control number. See 44 U.S.C. 3507. Also, www.cms.hhs.gov notwithstanding any other provisions of law, no person shall be subject to 1-877-267-2323, Menu Option 4, Ext. 61565 penalty for failing to comply with a collection of information if the collection of information does not display a currently valid OMB control number. See 44 U.S.C. 3512. The public reporting burden for this collection of information is estimated to average approximately four minutes per respondent. Interested parties are encouraged to send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Office of Policy and Research, Attention: PRA Clearance Officer, 200 Constitution Avenue, N.W ., Room N-5718, Washington, DC 20210 or email and reference the OMB Control Number 1210- 0137. [email protected]